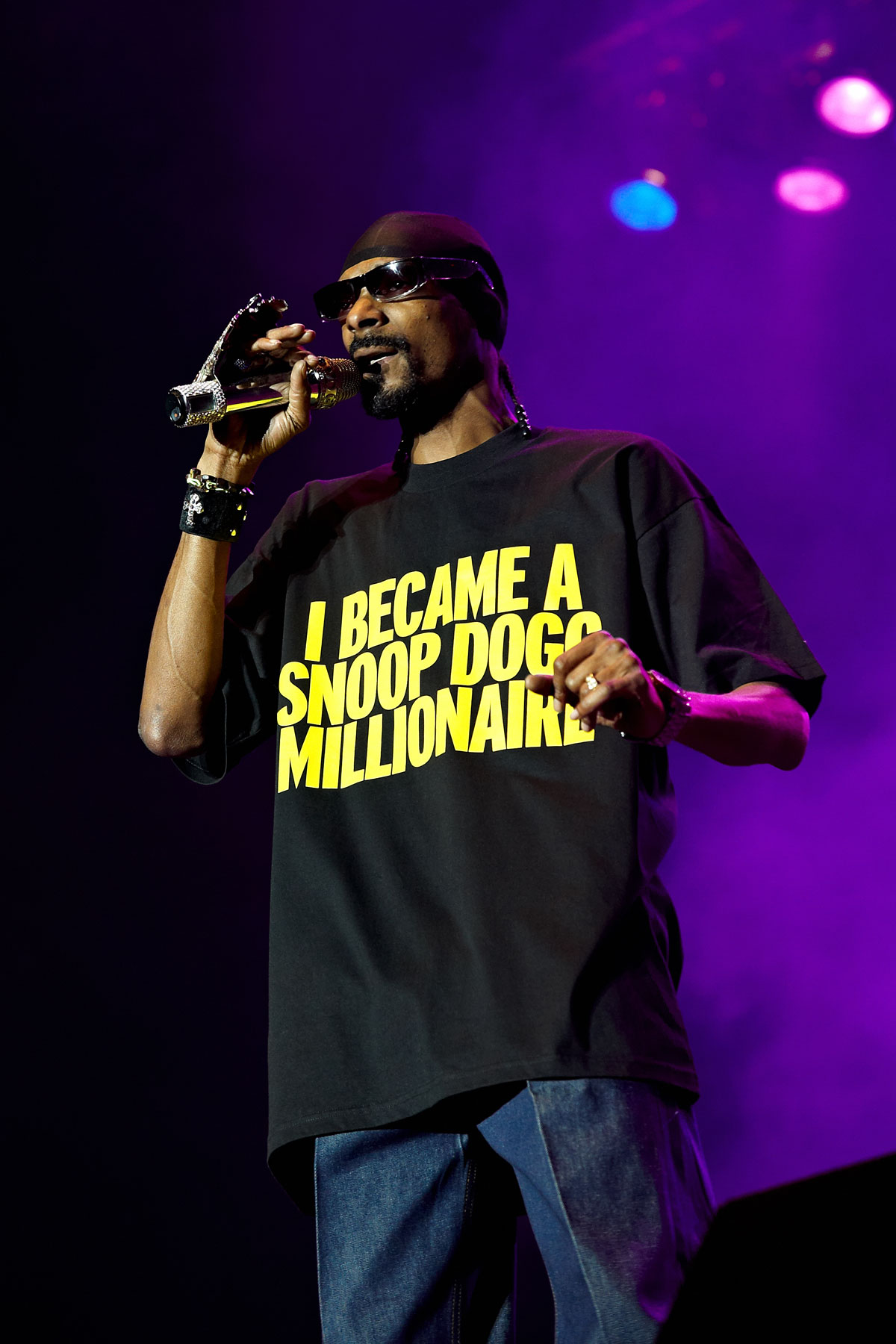

You'll Never Guess Where Snoop Dogg is Investing 25 Million Dollars...

By:

For a man who has claimed to smoke 81 blunts per day, it’s about time Snoop put his money where his mouth is.

A few days ago, news surfaced that the celebrated rapper, noted pot smoker, and apparent venture capitalist Snoop Dogg is looking to raise $25 million for an investment fund devoted specifically to hi-tech cannabis startups.

It’s the latest –– but perhaps least surprising –– focus in a string of recent tech-related investments for Snoop; in the last few months, the rapper has bought into the popular online forum Reddit, as well as the no-fee stock-trading venture known as Robinhood. But marijuana could prove to be his most lucrative investment yet.

Last December, TechCrunch reported on the impending marriage of two already profitable, burgeoning markets: legalized marijuana, and tech startups. In 2014, the site CrunchBase recorded 29 separate venture investments in cannabis startups with a total of around $90 million. While a large sum of that money was directed at Canadian companies, where medical marijuana is legal on a federal basis, the investment interest from venture capitalists portends a robust American market as lawmakers continue to legalize medical and recreational marijuana use in states across the country, and innovative entrepreneurs rush to get a piece of the weed pie.

U.S. investors are already on the go. Last year, the Founder’s Fund, the investing wing of billionaire entrepreneur Peter Thiel, who cofounded PayPal, was involved in a reported $75 million Series B for Seattle-based Privateer Holdings, which owns a variety of tech-y pot-centric companies. A Series B refers to the financing stage of a company that has established itself with milestones in business development, which Privateer has: last month, the company’s total funding was a reported $82 million.

Privateer is positioning itself to be a leader in all aspects of the “weed supply chain,” swooping up cannabis-focused companies that aim to resonate in a modern market, like the Yelp-esque Leafly, or the medical mail-order service Tilray. Privateer has yet to generate profit, but it was expected to bring in nearly $11 million in net revenue last year, and expects to reach profitability next year, generating an estimated $111 million in 2015, and $440 million in 2016.

While companies like Privateer jostle for the vanguard spot, powerful investor groups have been bringing up the rear. The global investor group Dutchess Opportunity Fund has poured thousands into numerous cannabis startups in the past year, ranging from a social networking site for the cannabis community, to a vaporizer startup, to a marijuana-based personal lubricant (which, admittedly, is not a tech startup, but still seems somehow noteworthy).

Other groups, like the Oakland, Calif.-based ArcView have been helping cannabis startups find investors and reach target audiences. According to Troy Dayton, CEO of ArcView’s cannabis investor network, over $18 million was invested last year in 34 companies involved with the group, whose members include real estate investors and organic food industry leaders, as well as a growing number of tech entrepreneurs and investors. “It’s a less mature space, and you’ve got some stigma to get over, but I think that the bow has broken on the talent problem –– we’re entering into a space where we’re starting to see some more really quality teams going after this,” Dayton told TechCrunch

Other companies, like the medical delivery-service startup Eaze, which received $1.5 million in investments from the venture firm Fresh VC last year, demonstrate a distinction some in the marijuana startup world have been cautious of––to touch or not to touch the plant itself. According to Douglas Leighton of Dutchess Opportunity Fund, the “industry has sort of bifurcated into two parts of investing –– one it touching the plant, and one is not. A lot of people will not make an investment that is touching the plant because of federal implications,” he told TechCrunch. But that distinction is evidently becoming less of a concern for investors with companies like Privateer, who are indiscriminate in their quest to conquer the lucrative, burgeoning industry.

For forward-thinking entrepreneurs and investors, marijuana might very well be the next big thing, uniquely positioned with an established space in society but with a nascent, malleable legal marketplace. But for Snoop and other like him, the old axiom “invest in what you know” will likely prove a reliable standby.