Here Are Some Shocking Tactics States Use to Collect Your Student Debt

By:

You probably knew that your wages could be garnished for defaulting on your student loans, but did you know that in two US states, your driver’s license could be revoked as well?

For instance, the Montana Department of Justice outlines that a DUI can net you a six-month suspension of your license for your first conviction and a one-year suspension for your “second or subsequent conviction within 5 years.”

Go further down the list of suspendable infractions, and you’ll see that those who default on a student loan face potentially steeper penalties. Defaulting on a student loan in Montana could net you an “indefinite suspension until [the] student loan association notifies [the Montana] Motor Vehicles Division of compliance.” For comparison, that’s the same penalty as being “medically unable to safely operate a motor vehicle.”

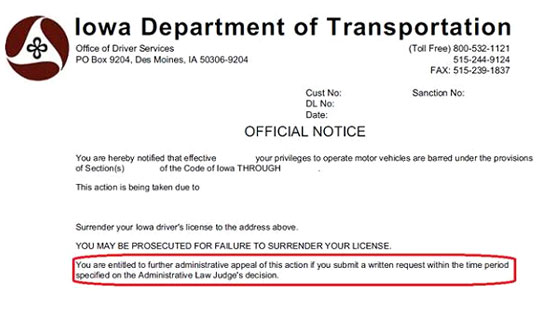

Iowa’s Department of Motor Vehicles has matching legislation, stating that Iowa “is required to suspend a person’s driver’s license upon receiving a certificate of noncompliance from the College Student Aid Commission in regard to the person’s default on an obligation owed to or collected by the commission.”

In plain English? Iowa will take your driver’s license away for defaulting on your student loans. (They will also revoke your license for “at least two, but not more than six years” if you are deemed a “habitual offender based on severe violations” which include “manslaughter resulting from the operation of a motor vehicle” and “serious injury by a motor vehicle due to operating while under the influence.” Fail to pay your student loans for years, and you won’t have a license until you resume some kind of repayment plan. Kill someone with your car, and you won’t have your license suspended for more than six years.)

These laws are actually enforced.

Putting the absurdity aside, these type of statutes are not simply antiquated laws that go unenforced; they have tangible impacts on real people. In Oct. 2010, 42 Tennessee nurses had their professional licenses suspended for falling behind on student loan payments. And although Montana’s default rate is low, over 600 people were currently in default from 2009-2012 according to Huffington Post and could have had their driver’s license suspended by Montana’s DoJ.

With nearly 70 percent of US college students using loans to finance their education and the average loan-taker graduating with nearly $33,000 in debt last year, the Wall Street Journal dubbed the Class of 2014 the “most indebted ever.” Millennials are also less likely to secure the high-paying jobs we need to to pay off our educational debt. As attn: previously outlined, 27 percent of graduates under age 25 are underemployed, and approximately 40 percent of unemployed workers are Millennials.

Where states treat student loan debt more harshly than drunk driving.

Laws like those in Iowa and Montana put Millennials in an even more precarious situation. Close to 40 percent of all rural residents in the US live in counties that offer no public transportation services according to research conducted, ironically, by the University of Montana. Without adequate public transit options, taking away a person’s driver’s license may itself cause unemployment. But while a Montana motorist may sometimes continue driving with a breathalyzer installed in their car after their first DUI (rather than face losing their transportation), a person that defaults on their student loans has no such alternative.

Eliminating the sources of income that a graduate already has or preventing them from securing employment altogether -- have you ever been asked about ‘reliable forms of transportation’ on a job application? -- creates a downward spiral that can lead to further indebtedness and poverty.

Millennials with student loan debt must risk what amounts to a modern debtor’s prison for trying to acquire the education we’ve been told that we need to succeed.

The problem can be even more inescapable for those with private student loan debt. Being debt averse and having received a hefty scholarship, I only have one private, institutional loan remaining. But if something were to happen that prevented me from paying even once, I would immediately go into default. It’s like playing roulette in exchange for the magic of zero-interest. Drafted? Check, please. Unemployed? Check, please. Dead? Check, please, next of kin.

Unlike a federal loan, I cannot defer payment for any reason. Thankfully, I live in a state where there’s no risk of losing my driver’s license -- and my only way to balance working four different jobs -- if I were to go into default.

Simply not taking on debt is clearly no longer an option for many students either. As noted by attn:, a student would be required to work a full-time minimum wage job for most of a calendar year to afford the average $14,000 per year tuition. This striking statistic doesn’t even account for the costs of private universities, where costs have skyrocketed more than 146 percent in the past 30 years.

President Obama alluded to a plan last week to wrangle America’s student debt by offering two free years of community college nationwide, which will be elaborated in his upcoming State of the Union. Addressing an audience in Knoxville, Tenn., earlier this month, Obama said of his proposal: “Opening the doors of higher education shouldn’t be a Republican issue or a Democratic issue. This is an American issue.” Sen. Elizabeth Warren (D-Mass.) has also called student loan debt an “economic emergency” -- seeking to increase college affordability with bills ranging from offering nearly zero-interest loans (like those given to Wall Street banks) to refinancing student loan debt via a new tax on America’s top income earners.

With a predominantly Republican Congress in the 114th session, Millennials will have to wait and see whether this bipartisan promise comes to pass. But rather that sitting on the sidelines again -- less than 1 in 4 Millennials are reported to have voted in the 2014 midterm elections -- we can stand up for our generation by registering or pledging to vote. Your peers, if not your wallet, will thank you.