Here's the One Secret Area Recruiters Look When You're Applying for a Job

By:

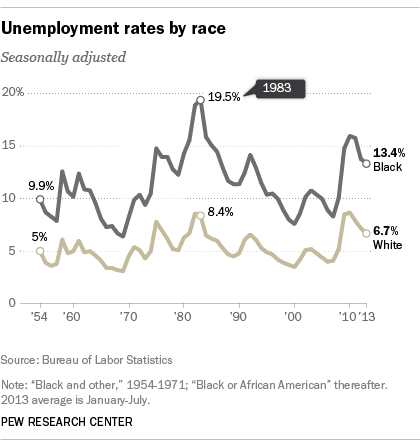

Why are unemployment rates for black Americans consistently higher than those for white Americans?

Certainly, outright discrimination plays a role, but researchers say bad credit reports might be a subtle, insidious factor that also contributes to disparities between black and white Americans.

And they also cause employers to discriminate against working parents and poor people, generally.

Your employer is probably checking your credit report.

When you apply for a job or a promotion, your employer can’t check your credit score -- the three-digit number that shows how much of a risk you are to those who might want to issue you a loan. They can, however, view your credit report, which includes details about your credit card debt, student loans, mortgage, car loans, and bankruptcy. Employers may check job applicants’ credit histories to get an idea of a prospective employee’s reliability or because they assume that workers with poor credit will find it hard to focus on their jobs while dealing with personal financial problems.

Unfortunately, according to Demos' report last year, credit checks may not give employers the information they’re looking for about job applicants—and, worse, employer credit checks reinforce employment discrimination against working parents and people of color.

Under the Fair Credit Reporting Act, when employers reject an applicant due to bad credit, the applicant must be informed that bad credit was the reason they were denied employment. According to a survey Demos conducted in 2012, however, only 1 in 7 job applicants with blemished credit histories were told that they were not hired because of their credit.

Bad credit reports are not always the result of bad habits.

Demos’ research found many factors that correlated with low credit—many of which had much more to do with a family’s financial situation than with the reliability or trustworthiness of the job applicant. For example, researchers found that low credit scores were common among families with children, households in which a wage-earner had been out of work for an extended period, and families that had incurred large medical bills.

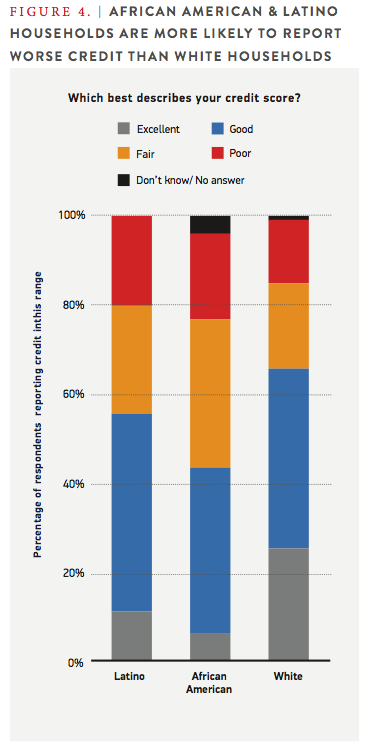

Additionally, African American and Latino households were more likely to have low credit scores than white households. Here's one possible reason -- these households are the targets of predatory lenders:

“[P]redatory lending schemes in the last decade targeted communities of color, compounding historic disparities in wealth and assets, and leaving African-Americans, Latinos, and other people of color at greater risk of foreclosure and default on loans.” -- Demos

Credit reports are often wrong.

Finally, credit reports are sometimes downright inaccurate and correcting a mistake may take dozens of follow-up calls to a credit reporting company.

When employers are screening out job applicants with poor credit reports, they’re not necessarily ensuring that they’ll hire more reliable employees. In fact, although credit reporting companies market their reports to employers, a spokesperson from a major credit reporting company testified to Oregon state legislators a few years ago that “we don’t have any research to show any statistical correlation between what’s in somebody’s credit report and their job performance or their likelihood to commit fraud.”

Employer credit checks discriminate against working parents, unemployed people, and people of color.

At the same time, all of the factors correlated with poor credit mean that employer credit checks make it harder for parents, unemployed people, and people of color to get hired. This means that employer credit checks reinforce discrimination in hiring practices that already exists against these populations—perpetuating trends like the gap between black and white unemployment.

Be sure to check your credit report!

If you’re a job applicant concerned that you might be losing job opportunities because of your credit report, you have some options. You can check your own credit report annually for free online at www.annualcreditreport.com (it costs money to see your credit score). If there’s an error on your credit report that’s making your credit seem worse than it should be, it’s possible to dispute that error with the credit reporting company.

We can fix this.

If you’re a policy wonk or political advocate, you can take action against employer credit checks. Currently, more than 10 states ban employer credit checks in most cases. The Equal Employment for All Act, introduced by Sen. Elizabeth Warren last month, would amend the Fair Credit Reporting Act to abolish employer credit checks across the country. Until the federal government makes it illegal for companies to check applicants’ credit, employer credit checks will continue perpetuating structural discrimination in hiring practices.