Here's How Much Money You'd Have If You Invested $1 a Day Since You Were Born

By:

If you've ever wondered how much your financial illiteracy and investing inactivity is costing you, you're in luck.

The investing website Stockchocker has a new tool that calculates how much more money you'd have had you been investing just $1 in the stock market each day since you were born or alternatively, since the date of your choosing.

Stockchoker - stockchoker.com

Stockchoker - stockchoker.com

The site's "Dollar-a-day" function allows users to input a certain date and find out, based on archived data from the S&P 500 index, how much a dollar-a-day investment would grow over whatever period of time the user delineates — a "crash course on compound interest," according to Stockchoker.

The tool takes closing price data from the S&P 500 — which is a measure of how well a certain section of the stock market is doing — on the first day of every month since the inputted date up until the present day, comparing the numbers for an overall percentage gain. According to the site, the "Dollar-a-day" tool essentially gives people the ability to quantify the hypothetical daily investment of small sums of money.

via giphy.com

Todd Froemling, who started the site, explained his reasoning behind launching the tool:

"The idea came to me when I was thinking about some financial blunders I'd go back and fix if time travel were possible. For instance, I'd start by going back 18 months and telling myself to avoid the energy sector. Then I'd tell my 23-year-old self to start making Roth IRA contributions."

The thought made Froemling kick himself for not putting "a little money in the stock market rather than waste it on something stupid" earlier on, he said.

Why Investing Works

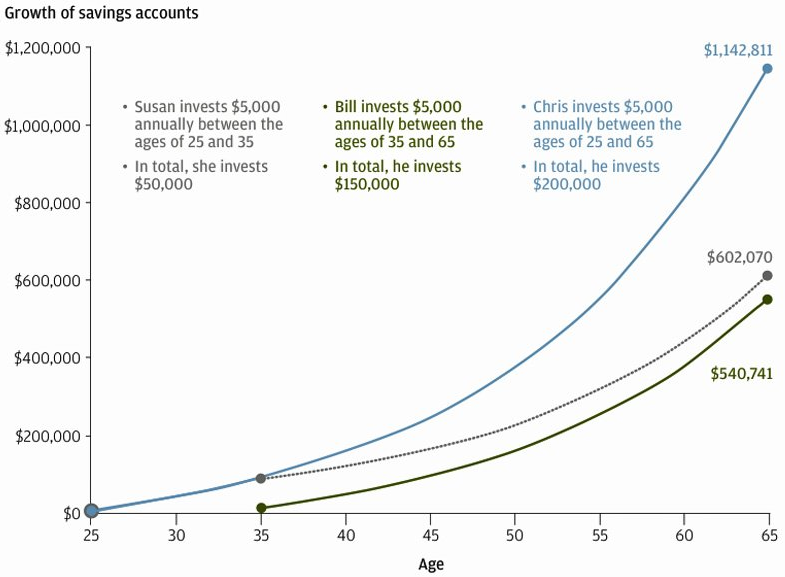

Financial experts recommend investing early and often, in large part because of compound interest, mentioned above. It's a simple calculation that has the potential to make huge differences down the road: the earlier you put aside, the more interest accrues on that money, which snowballs over time. This chart from JP Morgan Asset Management makes a strong case for taking advantage of compound interest:

JP Morgan Asset Management - jpmorgan.com

JP Morgan Asset Management - jpmorgan.com

Chris, who started saving at 25, had the best return on his investment. And even though Susan saved for four decades less than Bill, compound interest put her on top down the road.

Recent research has shown that Millennials, who continue to be haunted by the recession of 2008, are investing in the wrong ways. A survey conducted in February by the Swiss bank UBS found that 21 to 37-year-olds regretted selling too early and not buying when they could have, Business Insider reported. The report found that Millennials are not taking heed of the lessons from previous generations and the recession by "buying and holding." They were also the group least likely to hold to one investment plan and do not take on risk, even though they are likely to say the opposite.

There's a difference between squirreling away money in a savings account for the short term and investing it in something like a Roth IRA account that accrues tax-free interest and can be accessed at a set date years down the road. The thought of opening up your hard-earned money to the volatility of the market is perhaps unnerving, but other research suggests that even though Millennials might not be displaying best investing practices, they're at least doing it more and more — which in itself is smart.

"Even in the midst of unsteady market conditions and pockets of global instability, it’s extremely encouraging that so many people have taken positive steps to improve their ability to live comfortably in retirement, with many saving more, spending less and making smart investment decisions,” John Sweeney, executive vice president of Retirement and Investment Strategies at Fidelity, told Time.

If you're new to the investing game, there are a host of investing sites and apps that can help you make the most of your paycheck.