Americans Are Reluctant To Confront Wealth Inequality. But The Data Might Surprise You.

By:

In the years since the Great Recession, corporate earnings have steadily risen, but wages for the workers at many of the world’s largest companies remain stagnant, and according to many, unlivable. Not since the 1920s has America’s wealth gap been as wide as it is today. Meanwhile, the stock market this December passed the 18,000 mark, and many investors hope to surpass 19,000 next year if current trends continue.

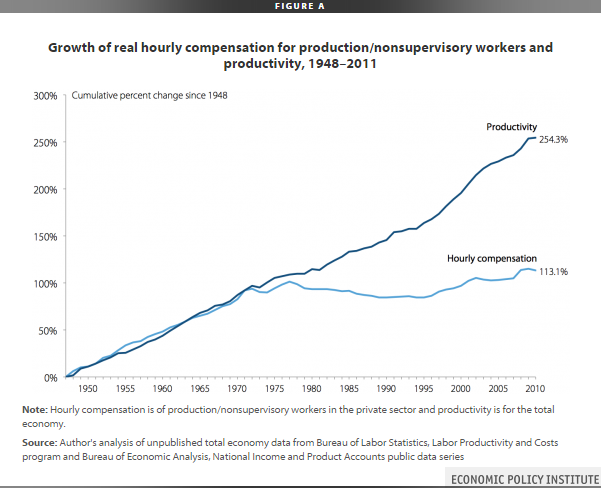

In the United States, worker productivity grew 80 percent from 1973 to 2011, according to the Economic Policy Institute. With greater productivity, however, did not come greater wages. According to the study, after inflation, hourly wages have grown by just one-eighth of that amount. Since 2000, it’s even more shocking, as productivity has increased 23 percent while real hourly pay is unchanged.

Thus, in the past 40 years, productivity is up, corporate earnings are up, profits are seeing record reports, and still, workers in the U.S. – and elsewhere – are not keeping up. The shareholders and CEOs of companies are generally reaping the benefits.

ThinkProgress.com reports that since the 1980s, individuals with more than $20 million in assets have seen the massive increases in wealth.

Author and Nobel Prize-winning economist Joseph E. Stiglitz also recently wrote in Vanity Fair: "the gap between the 1 percent and the 99 percent is vast when looked at in terms of annual income, and even vaster when looked at in terms of wealth—that is, in terms of accumulated capital and other assets.”

The 2014 battle over wages, which saw workers stage numerous protests and voice their demands for change, heightened Americans' understanding of inequality and the wealth gap. Still, for many observers and pundits, the American Dream is what keeps the country special.

According to the Pew Economic Mobility Project, about 62 percent of Americans raised in the top fifth of incomes stay in the top two-fifths, and about 65 percent born in the bottom fifth stay in the bottom two-fifths.

The statistics support this ideology as well. According to a study by Professor Edward Wolff of New York University, the gap between the rich and poor is staggering. The top 20 percent own some 85 percent of the wealth, while the bottom 40 percent of Americans own barely more than zero percent, and many have negative net wealth as a result of credit card and other debts.

Understanding the wealth gap and income inequality, says economists Stiglitz and others, including former Clinton administration Secretary of Labor Robert Reich, is the greatest impediment to American prosperity.

“The 5 percent of Americans with the highest incomes now account for 37 percent of all consumer purchases, according to the latest research from Moody’s Analytics,” Reich wrote. “That should come as no surprise. Our society has become more and more unequal.”

Income inequality is a touchy subject for America. Many argue that attempts to redistribute wealth is a form of “class warfare,” and this has left the debate largely on the sidelines. A disproportionate amount of Americans still believe they can become part of the top one percent, although public opinion appears to be changing, a problem Stiglitz says must be overcome if the US is to find solutions for these growing social issues.

With nearly two-thirds of Americans currently living from paycheck to paycheck, dealing with the wealth inequality today may be the only way to avoid a coming economic depression that could have far wider implications than politicians understand.

You can learn more about the fight for higher wages here.