Common Ways Tax Companies Are Ripping You Off

By:

It's an election year, so naturally voters have been hit with a litany of proposals — mostly from the Republican side — for tax reform. They include the following:

- Simplifying U.S. tax returns to the size of a postcard (possible, but it would explode the budget)

- Abolishing the Internal Revenue Service

- Implementing a flat tax or national sales tax

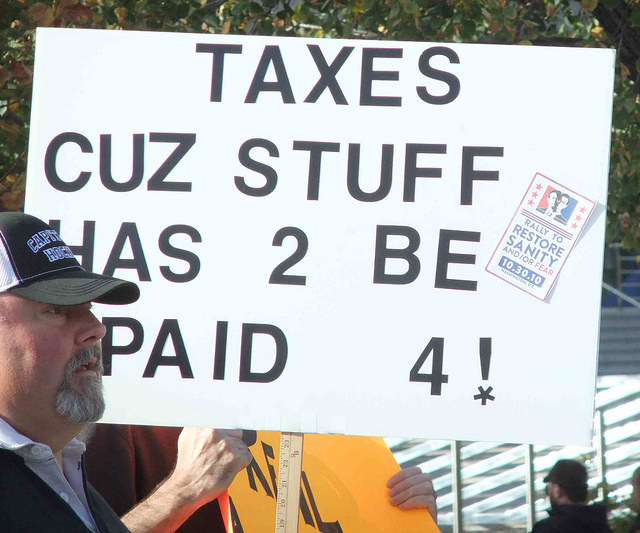

Some of these proposals sound like no-brainers. Who could oppose streamlining the complex nightmare that is the U.S. tax code and making it easy for an average citizen to understand and file taxes on their own?

But nothing's simple when you're talking about the tax system. For starters, there are about 1 million people who work in the tax preparation business who would find themselves out of a career. For another, there are powerful corporations whose business depends heavily on the convoluted nature of preparing tax forms, and they have little interest in making the process easier for people.

Flickr/Martha Soukup - flickr.com

Flickr/Martha Soukup - flickr.com

Software company Intuit — the maker of TurboTax — has repeatedly fought proposals for a simple "return-free" tax filing system that already exists in parts of Europe. Thanks to these kinds of efforts, tax time creates many opportunities for the average filer to get ripped off. The following companies are working hard to do just that.

Tax prep companies like H&R Block and Jackson Hewitt

Much like Intuit, tax giant H&R Block has fought to make tax returns more complicated for average citizens. That's no wonder, since the company's business model depends on consumers' willingness to spend $100 or more on preparing even the most basic tax return. The average cost of tax prep services was $189 per return at H&R Block and $208 at Jackson Hewitt, according to data from 2010 — and that's for consumers with simple returns who don't itemize deductions.

H&R Block and its top competitor Jackson Hewitt are the tip of the iceberg in a tax prep industry that's characterized by fraud and consumer abuse. So-called "fly-by-night" tax prep companies set up shop in malls and vacant storefronts on a temporary basis. They routinely charge consumers for so-called "free gifts" and set arbitrary fees for consumers who don't know better, according to blogger Nancy Meyer, who drew from her experiences working for one of these companies to outline tax preparers' underhanded tactics in apiece for the Daily Kos last year.

Professional tax prep services are necessary for some people with complex tax or business situations. But many finance pros agree that paying a tax prep company for a simple Form 1040 return is overkill and an enormous waste of money.

Biologist Michael Eisen brilliantly pointed out the absurdity of tax prep services by highlighting H&R Block's aggressive ad campaign from 2014 that instructed Americans to "Get your billion back!" The ads, which blanketed TV and the Internet, cited a recent study (by H&R Block, of course) that concluded that Americans who prepare their own taxes make mistakes each year that resulted in about $1 billion in potential unclaimed refund money. H&R Block guaranteed consumers that it could help them get the maximum possible refund.

But that the "$1 billion" figure is spread across 56 million families who filed tax returns — which averages out to less than $20 per return, Eisen wrote. If all of those families had gone to H&R Block, which charges an average of $198 per return for tax prep services, America would have spent about $11 billion to "get our billion back."

Services like TurboTax that try to sell "audit defense" with every return

Most people know enough about tax audits to know they want to stay far away from them: "Seinfeld" once called it "the financial equivalent of a full rectal examination."

The companies behind tax software products like TurboTax know this and leverage the scary reputation of a tax audit to sell "audit protection" services to every customer who prepares a return. TurboTax, for example, charges $40 per return for its "Audit Defense" package, which it offers at the end of each completed tax return.

Meme Generator

Meme Generator

The math doesn't add up to make these services worth the investment, though. The chances of being audited in a given year are about 1 in 116, according to available data. That risk drops to 1 in 300 if your return doesn't include business or rental income, expense deductions or the earned income credit — meaning that a typical taxpayer with a simple return would spend $12,000 on audit defense services from TurboTax before ever making use of them.

Moreover, three-quarters of IRS audits are handled by mail, and many of them end with a verdict in favor of the taxpayer —in 2014, almost 40,000 audits ended in refunds for the taxpayer, which added up to $830 million.

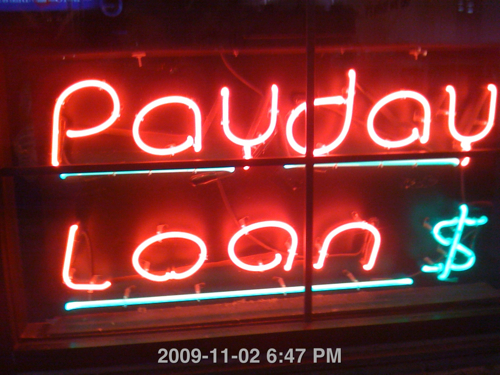

Companies that offer refund anticipation checks or "rapid refunds"

Many companies know that taxpayers are strapped for cash around tax time (especially if they've just shelled out for an expensive tax prep service), and in the past they used the opportunity to sell "refund anticipation loans." These loans were really just the equivalent of payday loans that use your tax refund as collateral, and they came with many of the pitfalls and abusive practices that characterized the payday lending industry for years.

Flickr/Jason Comely - flickr.com

Flickr/Jason Comely - flickr.com

Such refund anticipation loans largely went extinct at major banks after the IRS responded to outcry by cracking down on them in 2010.

But many companies have found loopholes that allow them to continue offering similar products, including "personal lines of credit" offered by tax preparers that are not technically connected to a tax refund. Many tax prep services also offer "refund anticipation checks" for a flat fee, which, although much better than the predatory loans of old, still come with high fees. Non-bank lenders also offer refund anticipation loans, although they aren't as prevalent as they were before IRS reform efforts.

H&R Block, which used to offer refund anticipation loans at APRs up to 180 percent, now offers federal "refund anticipation checks" for $34.95. They are still a waste of money, as the IRS offers direct deposits for refunds and generally issues them in fewer than 21 days, with refunds from simple returns going out within a week or so of filing.

[Update 3/25/16: Tom Collins, head of corporate communications for H&R Block, wrote us to express disagreement with several aspects of this story. Collins denied that H&R Block had fought to make tax returns more complicated for consumers, saying that the change in question would standardize eligibility questions for the Earned Income Credit (EIC) across filing methods, which would in turn help to reduce fraud and improper payments.

"The fact is that people who do their taxes using do-it-yourself tax software don’t have to answer the same eligibility questions that taxpayers who get help from a paid preparer [do,]" Collins wrote. "That’s an unequal and unfair standard, and it’s partially responsible for the $14 to 17 billion in EITC fraud and improper payments that occur annually."

Collins also disagreed with our assertion that Refund Anticipation Checks were a "waste of money" on consumers' part, saying that H&R Block customers appreciate the ability to pay for tax preparation fees out of their refund.

"Our clients like having that option, pure and simple," he wrote.]