Here's How Much Money States Take From The Lottery

By:

By Wednesday night, some lucky — or unlucky? — person or persons will probably be in possession of a certain string of numbers that will grant them access to the bloated $1.5 billion Powerball jackpot (before taxes, or course).

And while the odds of winning the jackpot are absurdly unlikely — about one in 292 million — states stand to win big regardless. In fact, all of the 44 states that participate in the Powerball game have already won in the form of revenue from lottery ticket sales. At least one state stands to win big twice — depending on where the winning ticket(s) lurks. But how much does that state stand to make?

Related: What You Need To Know About the Lottery

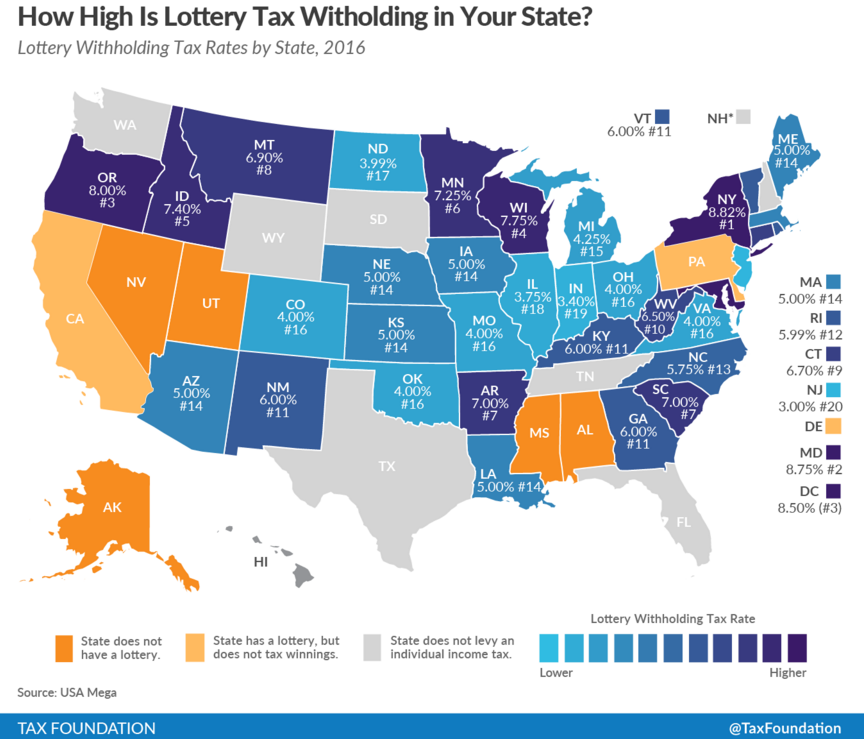

It depends on how much the state taxes the earnings.

Tax Foundation - taxfoundation.org

Tax Foundation - taxfoundation.org

Related: Which States Have The Best Odds For Powerball Drawing?

The chart above, from the Tax Foundation, shows a variety of tax breakdowns when it comes to lottery winnings at the state level. A Tax Foundation blog post explains that while most states, as well as the federal government, automatically withhold taxes on lottery winnings more than $5,000, just how much they withhold beyond that depends. In New York, for example, a winning ticket-holder would take home just under $615.5 million, as opposed to $697.5 million in a state where there is either no income tax or no tax on lottery winnings. (Though the jackpot is $1.5 billion, the actual lump sum is closer $930 million after an automatic federal tax of 25 percent.)

How much a state takes could mean a big difference for how much beneficiaries of that tax get. As ATTN: noted, lotto money, as well as paying for the game's administrative costs, generally goes to state funds where it is then distributed to public services such as education.

There are other variables, too, when it comes to taxed lottery money. On top of state and federal taxes, some local taxes apply: players in New York City and nearby Yonkers face local withholdings, which is too bad, since ATTN: predicted the winning ticket-holder could be a New Yorker, based off of 2013 lotto spending. Other differences can occur depending on what form the winner chooses to accept money in, such as in the lump sum form or spread out over scheduled payments.

Which is not to say that the more than $600 million take home prize isn't dizzying.