The Best States to Be a Smoker

By:

Think you know where your cigarettes come from? Think again. Cigarette taxes vary from state to state, creating varying degrees of costliness — and a cigarette black market.

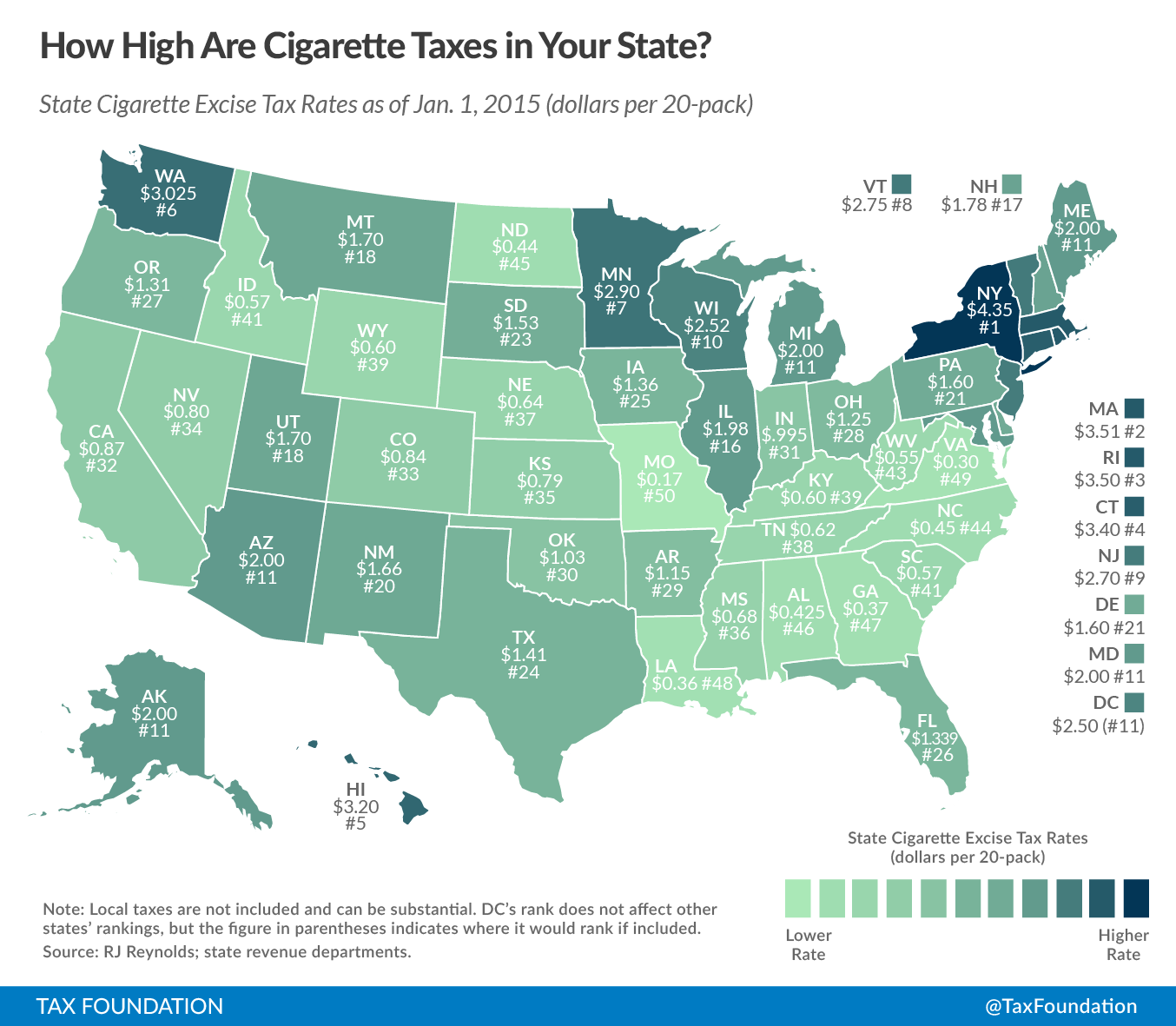

As the leading cause of preventable death in the country, the health costs of smoking are well known and relatively universal, but the price of a pack can vary greatly from one state to another. New York boasts the steepest cigarette tax, at $4.35, while Missouri smokers enjoy a mere 17 cent tax on a pack of "stogs." The map below shows where your state stacks up.

Tax Foundation - taxfoundation.org

Tax Foundation - taxfoundation.org

Though cigarette taxation has been linked to improved health in low-income countries, according to a report conducted by the American Lung Association, their effects on smoking cessation were minimal in most U.S. states in 2013.

Still, the CDC purports that taxation is one of the most effective ways to reduce the harm of second hand smoke and incentivize quitting, according to a report conducted by The Center on Budget and Policy Priorities.

History of the tax on tobacco.

A federal tax on tobacco was first introduced in 1864 for civil war revenue, while the first state-level tax was introduced in Iowa in 1921. By 1969, all 50 states as well as the District of Columbia passed cigarette taxes. Between 1995 and 2009, the average state tax rose from 32.7 cents per pack to $1.20, an increase of 267 percent. The CDC credits cigarette taxation with a 4 percent decrease in smoking, though taxes remain lowest in states where tobacco is a major crop, particularly the American Southeast.

The cigarette black market.

Beyond smokers road-tripping across the border for a cheap pack, increases in cigarette prices have also made way for a multi-million dollar cigarette black market, with 57 percent of packs sold in New York coming from out of state and many bodegas covertly selling them below market or offering "loosies" (single cigarettes) to customers off the books.

A report by the Mackinac Center for Public Policy concludes that more than a third of cigarettes consumed in New York, Arizona, Washington, and New Mexico in the year 2013 were smuggled in from out of state.

In 2010, Congress passed the Prevent All Cigarette Trafficking Act, and a 2011 law requires that New York and New Jersey governments destroy contraband products rather than auction them off. In 2013, the City of New York and The American Lung association asked the U.S. Food and Drug Administration to pass a nationwide tracking system on cigarettes in hopes of thwarting smuggling.

Wikimedia - wikimedia.org

Wikimedia - wikimedia.org

Benefits of the tax.

Though low-income smokers are those most affected by shifts in tobacco prices, one study concludes that they also benefit most from tobacco tax revenue, paying 11.9 percent of tobacco tax increase since 2009 and receiving almost half of the health benefits.

Still, many anti-smoking groups and advocates insist that not enough tax revenue is being devoted to smoking cessation programs.

At $2.51, Massachusetts has one of the highest cigarette taxes in the country, bringing in $562 million in 2009, yet the state only spent $4.5 million on anti-smoking programs the following year. As none of the money is earmarked for specific programs, it’s up to Massachusetts lawmakers to decide what cigarette tax revenue is used for.

“Right now the program is funded at less than 1 percent of what the state brings in in tobacco revenue,” Russet Morrow Breslau, the head of Tobacco Free Mass, told CBS.

“If you’re going to increase prices on cigarettes and tobacco products you need to use that money to help people quit smoking,” he argues.

Exactly how these taxes are used varies on a state-by-state basis, and is not always related to anti-smoking efforts. New York cigarette taxes have paid for dump trucks, golf carts, and a new county jail, while Virginia puts the revenue toward broadband cable networks.

Former New York Mayor Bloomberg deems increased cigarette taxation among the most important accomplishments of his administration, saying ''If it were totally up to me, I would raise the cigarette tax so high the revenues from it would go to zero,'' according to a report by The New York Times. Though our cities are far from smoke-free, as taxes rise in many major cities, it's certainly getting pricier — and more difficult to justify — lighting up.