The Best States to Buy Beer, Mapped

By:

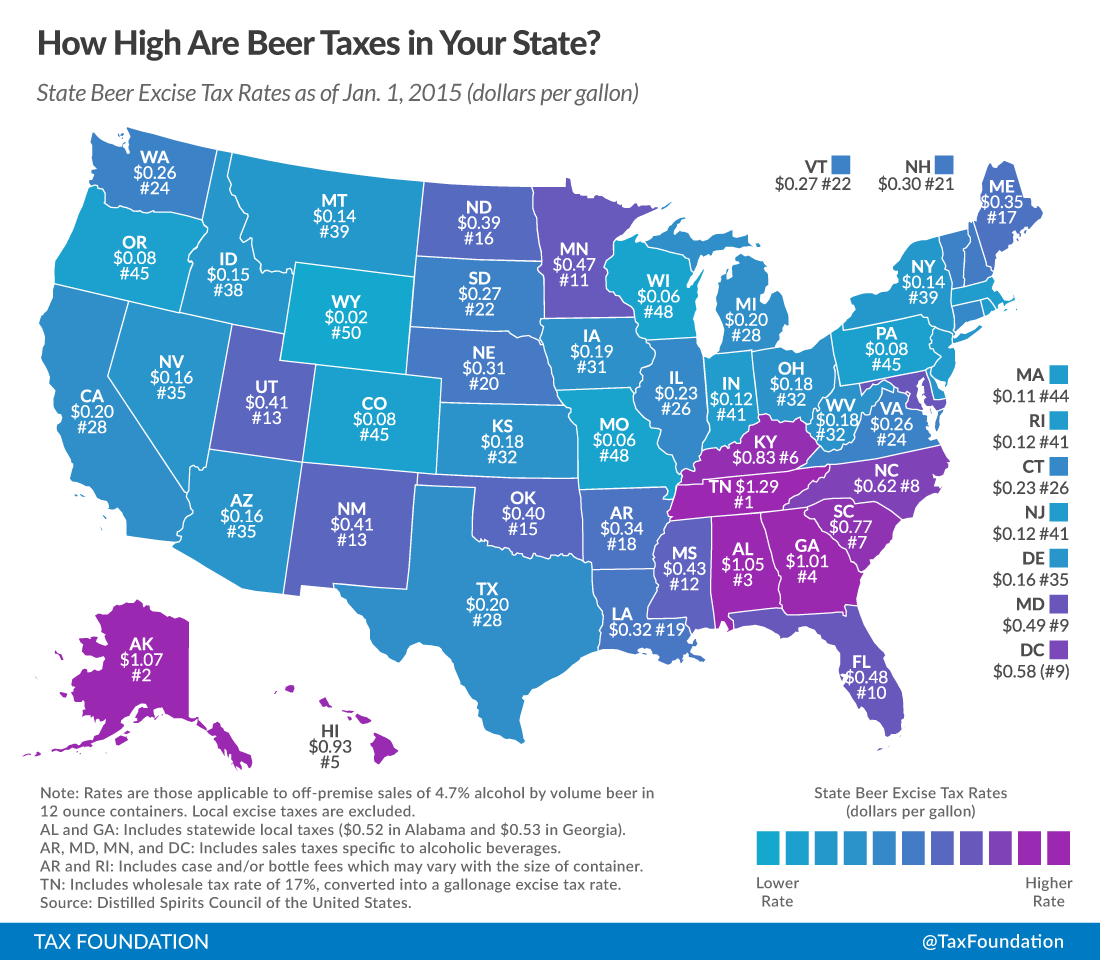

For beer lovers, where you live can makes a big difference on how much you pay for a pint. Depending upon state and local liquor control laws, the excise tax rate — an indirect form of taxation that's imposed on certain goods such as alcohol, gas, and cigarettes — can range from mere pennies to a dollar and change per gallon, and the rationale behind the tax differences is often unclear.

RELATED: America Has an Affordable Housing Crisis

In Wyoming, beer is taxed at $0.02 per gallon, whereas folks in Tennessee pay an additional $1.29 per gallon. That's according to data from the Tax Foundation, a tax policy research organization. Each year, the Tax Foundation comes out with a map showing alcohol tax rates on a state-by-state level.

Here are the states where beer taxes are highest and lowest.

Tax Foundation - taxfoundation.org

Tax Foundation - taxfoundation.org

"State and local governments use a variety of formulas to tax beer," the Tax Foundation said. "The rates can include fixed per-volume taxes; wholesale taxes that are often a percentage of a product’s wholesale price; distributor taxes (sometimes structured as license fees as a percentage of revenues); case or bottle fees (which can vary based on size of container); and additional sales taxes (note that this measure does not include general sales tax, only those in excess of the general rate)."

Interestingly, North Dakota and New Hampshire rank highest in a list of states that consume beer, Fox News reported. Yet those states also have some of the highest beer taxes, at $0.39 and $0.30 per gallon, respectively.

The Beer Institute, a trade association that represents the $246 billion industry, says that "taxes are the single most expensive ingredient in beer, costing more than labor and raw materials combined." The association is pushing for reform of the federal excise tax rate — which currently stands at $18 per barrel (31 gallons of beer) — to $3.50 per barrel.

RELATED: This Map Shows Where America's Hate Groups Live and Operate

"On average, more than 40 percent of what American beer drinkers pay for a beer goes toward federal, state, and local taxes — from excise to consumption to sales taxes, as well as the normal business taxes," the Beer Institute reported. "Research shows that the tax burden borne by beer drinkers is more than 68 percent higher than for the average purchase made in the U.S."

But while it might be a pain to spend more on beer, the National Institute on Alcohol Abuse and Alcoholism argues that the federal excise tax is important, pointing to a 1997 study that found that raising the federal excise tax on beer reduced the number of drinking and driving incidents in the U.S.