Why You Won’t Be Able To Retire Until You’re 75

By:

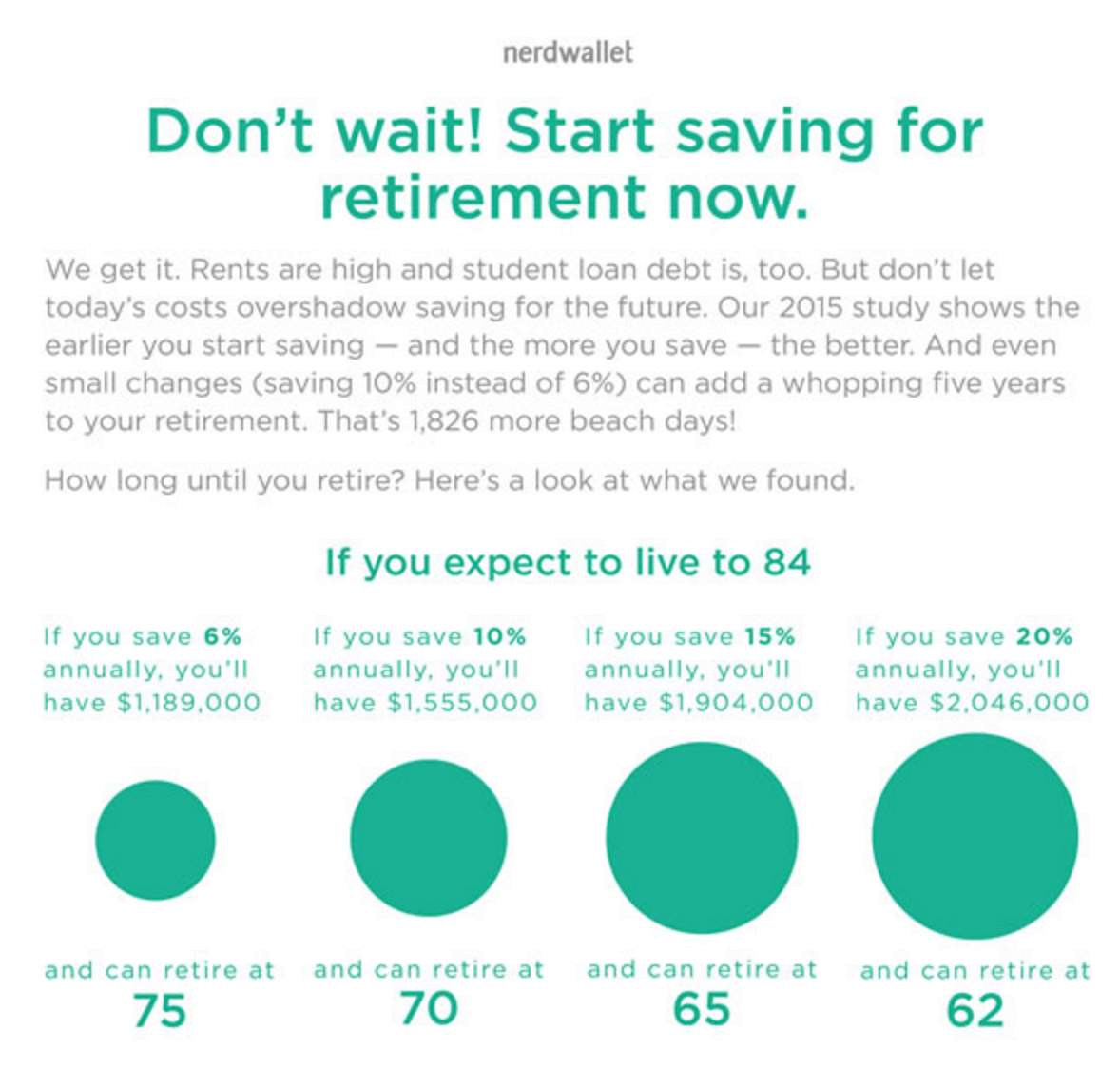

A recent study from personal finance website NerdWallet found that 2015 college graduates won’t have enough money saved to retire until they are 75 years old.

Rising rent prices and student debt have something to do with it.

RELATED: 5 Ways Student Debt Affects You -- Even If You Don't Have It

NerdWallet - nerdwallet.com

NerdWallet - nerdwallet.com

That means only nine years of potential retirement, according to the study, which explains that average life expectancy is 84 years old.

NerdWallet's research is based on the current U.S. median starting salary for a 23-year-old of $45,478, with a 3 percent raise each year. You can read the full methodology of the study here.

What's the damage?

According to CNBC, Millennials have definitely been short-changed on their retirement. Between the dot-com bust, the attacks on September 11, 2001, the wars in Iraq and Afghanistan, and the Recession, we don’t exactly have a head start on our 401k.

Amidst the turmoil, CNBC reports, companies downsized, outsourced, and mechanized jobs as 84 million Millennials grew up to work. The cost of higher education has skyrocketed in recent years and student debt is now in the trillions.

RELATED: Millennial Parents Are the Poorest in Decades

What does this say about your lifestyle?

There’s a chance you might move in with your parents. That’s what the White House’s Council for Economic Advisors say, at least. About 31 percent of 18-to 34-year-olds live at home. The relationship between Millennials and their parents is different from previous generations. Those close relationships might mean living with mom or dad longer.

Others live with multiple roommates to balance out rent or other financial needs.

It's a choice many people have to make, and as Business Insider proposes, there's an important question: How do you choose? When you have bills for rent, student loans and retirement, which is the most pressing? It can be a difficult battle to wage.

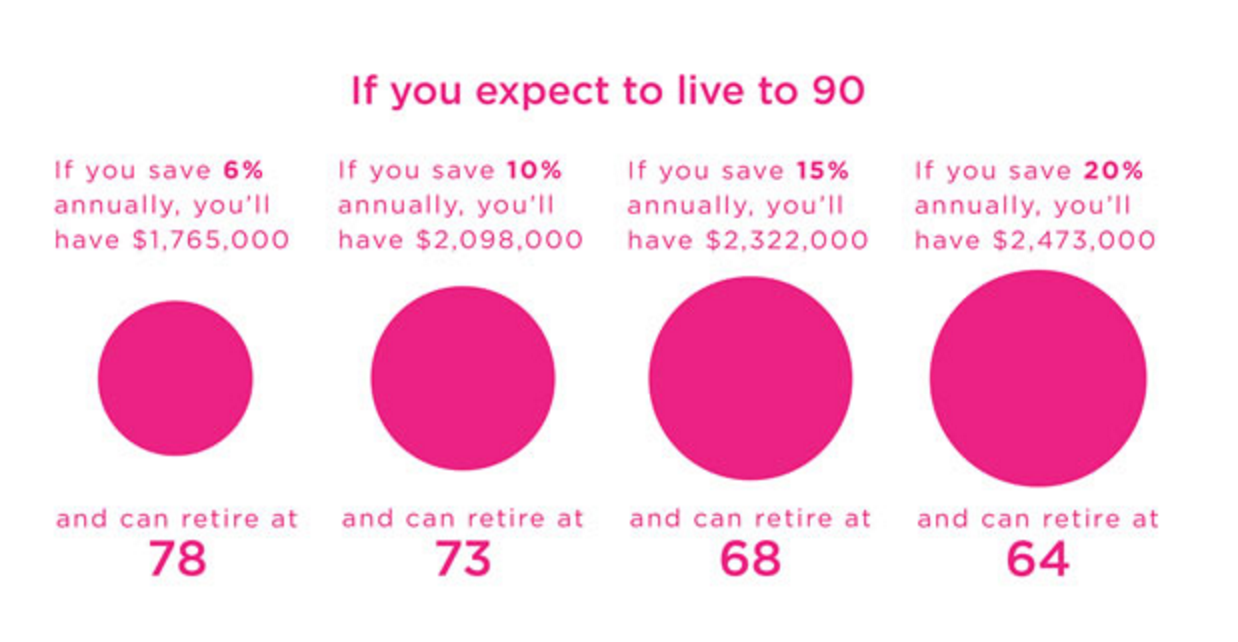

RELATED: Millennials Set to Live to 100 Years Old

You can start saving today.

All hope isn’t lost, though. There are strategies you can use to start saving for retirement now. NerdWallet says that if you’re a Millennial, time is on your side, but don’t keep saved money in your pocket. Invest it in the stock market, despite the distrust you may feel at its turbulence.

“My advice to Millennials I speak with is to realize that throughout the history of the investment markets, there have always been traumas,” says Daniel Sheehan, a certified financial planner on NerdWallet’s Ask an Advisor platform.

RELATED: Here's the Downside to Low Rent

“For those who invest wisely — allowing the market time to do its work by compounding — there isn’t a better way to invest for their future than the stock market.”

NerdWallet - nerdwallet.com

NerdWallet - nerdwallet.com