Meet the 23-Year Old Google Employee Who Lives in a Truck

By:

A 23-year-old software engineer at Google has given new meaning to the phase "living within your means." He currently resides in a 128-square-foot truck on the company's parking lot in an effort to save money and avoid the exorbitant rent prices of San Francisco.

Thoughts from Inside the Box - frominsidethebox.com

Thoughts from Inside the Box - frominsidethebox.com

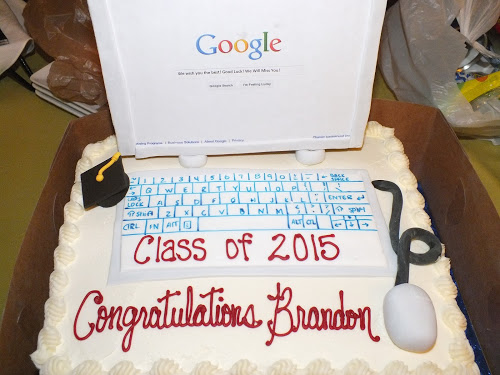

Brandon, who asked not to be identified by his last name or photo, told Business Insider that he was a recent college grad who moved to California from Massachusetts in May. After paying around $2,000 per month for the cheapest corporate housing option as an intern during the previous summer, he came up with this unconventional way to cut costs, increase his savings, and pay off his student loan debt.

After graduating, Brandon had $22,434 in student debt—roughly $6,000 less than the national average—and in the past four months, he's managed to pay it down to $16,449. And he recognizes that he's lucky.

Thoughts from Inside the Box - frominsidethebox.com

Thoughts from Inside the Box - frominsidethebox.com

"Because I landed such a lucrative job, I haven't seen student debt completely take over my life," Brandon told ATTN:. "I know for a lot of Americans, especially those who are accumulating two or three times as much debt as I had, the debt prevents them from buying a home or making larger investments that they'd otherwise be able to make, but my situation is more that I'm recognizing the opportunity to save money by paying my debt off more quickly."

"The debt (especially since I'm still in my grace period) hasn't caused any problems for my life, but I know I can save thousands by paying it off now as opposed to over the next 10 years," he added.

Around the time that he returned to San Francisco to work full-time, Brandon bought a 16-foot 2006 Ford E-Series truck for $10,000. Besides monthly truck insurance payments of $121 and gas, most of his living expenses are covered. He eats, exercises, and showers on Google's campus, saving more than 90 percent of his income.

Thoughts from Inside the Box - frominsidethebox.com

Thoughts from Inside the Box - frominsidethebox.com

"So for a super conservative estimate, I'm saving about $33,000 over the course of four years," Brandon wrote in a blog post. "That's just the raw minimum savings. I'll be investing approximately 95 percent of all of my post-tax, post-401k, post-benefits income. I've mentioned many times that it isn't about the money, but clearly this living situation makes my future plans much more flexible."

And if you're wondering how a Google employee gets by without electricity, he has an answer for that, too: Brandon says he doesn't own anything that needs to be plugged in, he uses a battery-powered lamp, and his work laptop stays charged throughout the night. When he gets in to work the following day, he simply charges the device up and starts over again.

While Brandon is certainly fortunate to have a job that pays well— which has made it easier for him to pay down his student debt—and also allows him to save on basic living expenses—groceries, water, gas and electricity—his truck-living experiment is still telling.

Rising rent costs are still a problem, especially for urban areas such as San Francisco, where the tech industry has contributed to the gentrification of the region. Brandon also brings up the issue of savings.

We can't reduce his story to one of paying rent versus creating a savings account, because, per his blog, Brandon is focused on saving and looks at this as an experiment. However, Millennials with low-paying jobs (either minimum wage, or entry-level salaried positions) are struggling to save due to the cost of basic living standards—or Millennials are moving in with their parents to save on the high cost of rent.

Approximately 62 percent of Americans have less than $1,000 in their savings accounts, and 21 percent report having no savings accounts, according to the finance website GOBankingRates.com.

You can follow Brandon's adventures on his blog, Thoughts from Inside the Box.