85 Years Ago Was The Worst Stock Market Crash In History; Are We Any Better Off Today?

By:

Eighty-five years ago this week (in 1929), the stock market crashed and plunged the United States into the Great Depression. The New York Stock Exchange sank 25% over the span of two days of trading, netting a loss of $14 billion on October 29 alone (roughly $438 billion in 2014 dollars). Historians and economists have looked back and seen that one of the root causes of this collapse was severe income inequality, a phenomenon that has resurfaced lately in a frighteningly similar fashion.

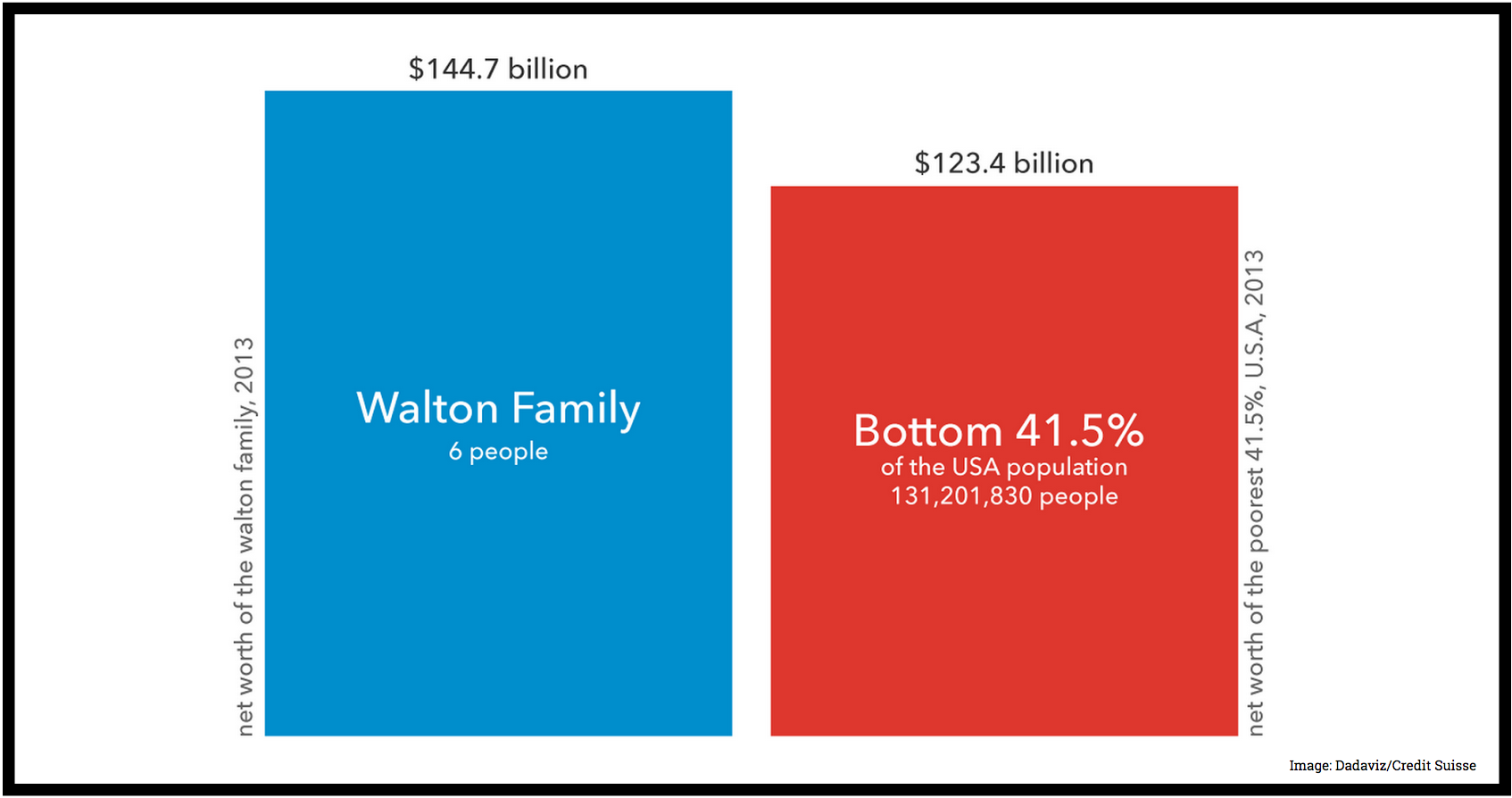

When comparing the two eras, the resemblance between the amount of income shared by the wealthiest 1% of Americans in striking. In 1928, at the height of the pre-collapse economic boom, the top earners in America were in control of 23.9% of the nation's wealth. After 40 years of narrowing the gap between the top and bottom earners, American income started to diverge once again in 1980, reaching its highest point in 2007, when the 1% took home 23.5% of the country's wealth. According to reports, almost 95% of 2009-2012 income gains went to the wealthiest 1%.

After the Great Recession, the recovery supposedly began, but so far we have seen a huge portion of that recovery go back to the top earners, whose average wealth is almost back up at 2007 levels, while the average income of the bottom 90% is no higher than it was in 1986. In fact, the household income for Americans in the 50th percentile has gone up only 3% since 1973, from $50,246 to $51,816. In that same period, average income for the 95th percentile has skyrocketed 36% from $142,662 to $195,968. The numbers for the top 1% are even more outrageous.

Representing the incomes of the top 1% with respect to those of the rest of the population results in data points that are literally "off the charts."

As explained in the video,the ideal income distribution, as picked out by more than 92% of respondents, is the most equitable distribution. And even though people know the system is not ideal, their guesses about what the distribution looks like is still way off.

One current step being taken to help close this gap is to raise the minimum wage. The Economic Policy Institute has found that a higher wage has no statistically significant effect on job loss, while data from the Department of Labor indicates that the 13 states who have raised their wages in 2014 have experienced faster job growth than those who did not. In a country where the average CEO to worker pay ratio has ballooned 1000 percent since 1950, higher wages are sorely needed. Thankfully, several states have minimum wage increases on their ballot next Tuesday.