The Government Is Looking Into a Major Allegation About Amazon's "Deals"

By:

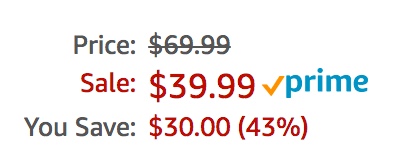

When buying something on Amazon, most of us just look for the big red number that indicates Amazon's price. But often, above Amazon's price sits another, higher value. That number is called the "reference price," and it's designed to show consumers how much they're saving by shopping on Amazon.

Ethan Simon - amazon.com

Ethan Simon - amazon.com

But according to one watchdog group, Amazon routinely inflates that value to make their price look like a bargain.

Back in March, the California-based advocacy group Consumer Watchdog filed a complaint with the California Attorney General, alleging that Amazon was inflating their list prices beyond their real market value. In the petition, John M. Simpson, Consumer Watchdog's Privacy Project Director wrote, "the reference prices were an entirely bogus notional price that created the false impression that customers were getting a deal when they were not. When correcting the inflated list prices, the fictitious discounts often vanished."

Simpson's statement added, "an examination of Amazon’s website from Feb. 3 – Feb. 6 of more than 4,000 products found Amazon published reference prices with a line through them on more than a quarter of its listings, and that the majority of these crossed-out prices exceeded—sometimes by large margins—any plausible definition of the “prevailing market price.”

Asked what a list price was supposed to convey, Simpson told ATTN:, "We were trying to figure out what could be meant by a list price with our first study. It’s got to have a real relationship to a price actually being charged, which is why we compared to both mean and median averages."

According to Simpson, they studied prices over a 90-day period, and that's not an arbitrary amount of time. "We cited 90 days because some states have a specific period in which historical prices —“was prices” — must have been charged. It’s 90 days in California, 28 days in NJ."

If Consumer Watchdog's claims are true, Amazon is violating California Law.

As Simpson says, the 90 day standard comes straight from California law. The California Business and Professions Code, Article 1, Sec. 17501 states: "No price shall be advertised as a former price of any advertised thing, unless the alleged former price was the prevailing market price as above defined within three months next immediately preceding the publication of the advertisement..."

Now, the Federal Trade Commission is investigating those claims.

As Amazon begins the process of acquiring Whole Foods, a merger that has drawn skepticism as a potential anti-trust violation, the Federal Trade Commission has stepped in to investigate the claims. According to Reuters, the FTC has made "informal inquiries about the allegations," but has not yet opened a formal probe.

Amazon flatly denies the allegations.

In a statement released to Reuters, the company claimed Consumer Watchdog's methods were flawed, saying, "the conclusions the Consumer Watchdog group reached are flat out wrong. We validate the reference prices provided by manufacturers, vendors and sellers against actual prices recently found across Amazon and other retailers."

But Amazon settled a similar complaint levied by Canada's Competition Bureau in January.

Robert Scoble - flickr.com

Robert Scoble - flickr.com

According to the Financial Post, Amazon was hit with a one-million-dollar fine for doing inflating list prices in Canada. They were also ordered to pay $100,000 to the Bureau to cover the government's costs in dealing with the dispute. A statement from the Bureau reads, "the agreement reached today resolves the Bureau’s concerns and sends a clear message to the marketplace that unsubstantiated savings claims will not be tolerated."

It's not clear right now what might come of the inquiry.

But Simpson says he wants the FTC to block the Whole Foods deal until it's resolved. "We want the FTC to block the Amazon-Whole Foods $14 billion deal until Amazon formally consents to stopping the deceptive pricing..."