Here's How Much Money You Need to Make in Each State If You Want a Two-Bedroom

By:

It's no secret that over the past forty years, wages have largely stagnated as the cost of living has increased. That fact was a hallmark of Senator Bernie Sanders' failed presidential bid, and it's a much-talked about reality in the 2017 economic landscape.

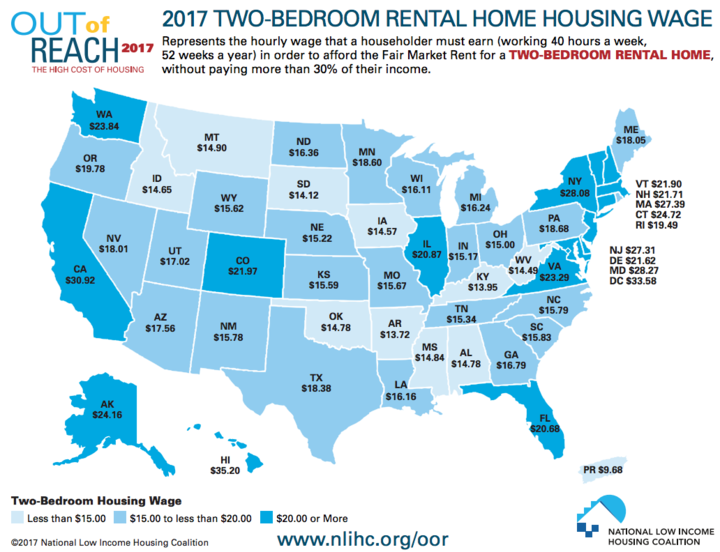

One way to illustrate what that means, in the real world, is this chart showing what hourly wage a worker needs to afford a two-bedroom home in every state—assuming they spend no more than the recommended 30 percent of their income on rent.

National Low Income Housing Coalition - huffingtonpost.com

National Low Income Housing Coalition - huffingtonpost.com

The results are depressing.

The first thing that becomes clear is there is no state in America where a full-time, minimum wage worker can afford a two-bedroom home. This is true even in states with higher minimum wages, with housing costs rising faster than wages. The state with the most affordable housing is Arkansas. There, one needs a job paying $13.72 an hour to afford a two-bedroom home. However, the minimum wage there is just $8.50 an hour. Hawaii is the most expensive state—in order to afford that Maui two-bedroom, you need to be making $35.20 an hour (the minimum wage is just $9.50).

If depressing graphs are your thing, there's no shortage when it comes to the affordable housing crisis.

This one shows how many hours you'd need to work at minimum wage each week to afford a two-bedroom. Hawaii takes the cake at 124—more than three times the standard 40-hour work week.

National Low Income Housing Coalition - attn.com

National Low Income Housing Coalition - attn.com

And the government isn't doing much to fix it.

It's a two-sided equation. Either wages need to rise, or housing costs need to fall, and the U.S. government hasn't done a great job addressing either side. On the wages end, our minimum wage simply isn't high enough. And on the supply side, federal funding for affordable housing programs—like rent vouchers or public housing—has dropped off heavily in the past decade. According to The New York Times, "Between 2010 and 2012, financing fell by about $2.5 billion, or nearly 6 percent, although some of this was mitigated by one-time measures, like spending from reserves."

Something's gotta give.

The situation is clearly untenable, and something needs to change. Renewed efforts to raise the minimum wage under the "Fight for 15" banner have gained some traction recently, which might help offset the rising costs of housing. But tackling the crisis will require broader, systemic change, from making wages rise again, across the board, to ensuring that new housing is priced within the reach of more than just the well-off.

Do you think housing costs should be lower?

- Correction:June 19, 2017This piece was corrected to show that Hawaii not Virginia requires the most hours of work to afford a two-bedroom rental home. ATTN: regrets the error.