Robert Reich Breaks Down Today's Wall Street Rally

By:

The stock market reached a historic milestone on Wednesday, with the Dow Jones Industrial Average closing above 20,000 points for the first time. Financial experts have credited President Donald Trump, who favors de-regulation policies on Wall Street, for generating excitement among investors and helping to push the market past this threshold.

Google Finance - google.com

Google Finance - google.com

The Dow Jones is one of the most respected stock market barometers, showing the “price-weighted” value of 30 major companies. It doesn’t reflect the actual value of all 30 stocks — rather, the value of a company’s stock depends on its relative importance — but financial experts look to the Dow for a rough estimation of Wall Street’s overall health.

"The stock market has given him this extraordinary vote of approval," Ed Yardeni, President of the stock market research firm Yardeni Research, told CNN. "Happy days are here again."

But in a Facebook post, former Secretary of Labor Robert Reich argued that the momentum in the financial sector was temporary and that excitement over the day's rally ignores the fact that most working class Americans won't benefit from the boon.

Reich agreed that the record-breaking gains on Wall Street were indeed largely attributable to Trump because "[f]inancial markets expect higher corporate profits — stemming from lower corporate taxes, fewer regulations, and major infrastructure spending." That said, the president's unconventional approach to international trade deals, and his overall unpredictability, will likely create volatility in the global financial market, he wrote.

Trump signed an executive order on Monday that formally withdrew the country from the Trans-Pacific Partnership (TPP) — a trade agreement between the U.S. and 11 other countries located around the Pacific Rim — and he's also pressing forward with plans to renegotiate the North American Free Trade Agreement (NAFTA). In a recent interview with ATTN:, the Brookings Institution's Joshua Meltzer said these positions signal "enormous uncertainty to the rest of the world about the continuity of U.S. economic policy and the ability for other countries to place trust and rest political capital in following U.S. leadership on economic policies going forward."

But for the time being, the U.S. market is going strong. And enthusiasm on the trading floor was echoed on Twitter with the hashtag "Dow20K" Wednesday morning.

Reich wrote that the excitement from everyday citizens over the Dow Jones gains was misplaced, arguing that "American workers" wouldn't be able to cash in on Wall Street's success.

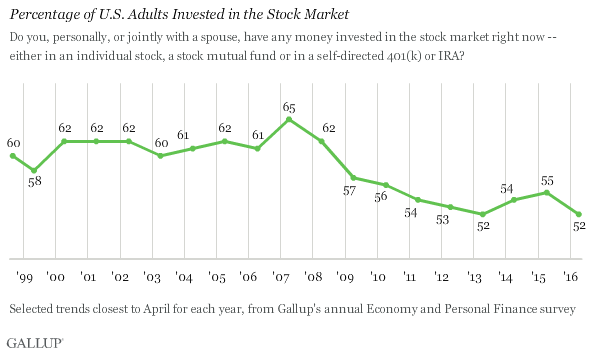

The stock market is certainly one indicator of the national economy's health, but record-high shares won't directly translate into profits for about half of the country, which doesn't have any money in the stock market, according to a 2016 Gallup survey. Only 30 percent of American adults with annual incomes at less than $30,000 have stocks, while 79 percent of those with incomes higher than $75,000 do.

Gallup - gallup.com

Gallup - gallup.com

"While a slight majority of Americans report investing their money in the stock market, it's a far cry from pre-recession levels that spanned 58% to 65%," Gallup found. "Fewer Americans — particularly those in middle-income families — are benefiting from the recent gains in stock values than would have been the case a decade ago."