Most People Are Unprepared for Even a Minor Financial Crisis

By:

Finding a hefty and unexpected bill in the mail is never a pleasant surprise, and a new survey finds most people don't have enough money to cover one.

The findings, published by financial website Bankrate, are based on phone interviews with 1,003 adults living in continental United States.

Of those surveyed, 59 percent said they don't have enough money saved to cover an unplanned $500 expense.

“It’s not a matter of if, but when an unexpected expense will pop up,” Bankrate analyst Jill Cornfield wrote. “If you have a car, a house or apartment, a pet, or a kid – if you’re a member of the human race – something that costs money is bound to go wrong.”

Here's what people said they would do if they were hit with a $500 bill.

Over 20 percent of those interviewed said they would charge the bill to their credit card, while 20 percent said they would cut spending to compensate. Another 11 percent told researchers they would seek help from friends and family.

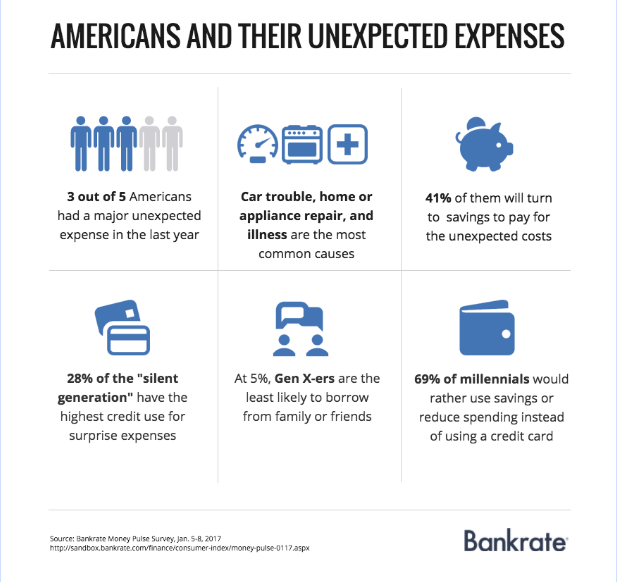

Bankrate packaged the results on Americans' spending habits in a graphic included in their survey write-up.

Bankrate - bankrate.com

Bankrate - bankrate.com

By late December 2016, U.S. households on average had $16,061 in credit card debt, "just below the high water mark of $16,9111 set in 2008," CNBC News reported, citing data from personal finance site NerdWallet.

"If you aren't set up to tap cash for something, it can derail you financially if you put it on credit card," Cornfield said. "The original expense can bloom because of interest."

The study also revealed a generation gap with respect to saving and finance habits.

Millennials reported greater financial preparedness in the Bankrate survey, with 47 percent of people between the ages of 18 and 29 telling researchers they could cover a $500 bill with their savings, up from 33 percent in 2014. Overall, just 37 percent of U.S. adults say they could cover an unexpected $500 expense by tapping into their savings. But the picture certainly isn't rosy for the younger crowd or the general public.

Flickr/401(K) 2012 - flic.kr

Flickr/401(K) 2012 - flic.kr

The survey results are backed by other research.

In a 2016 report, the Federal Reserve presented its findings from polling 5,600 Americans about household finances.

"Forty-six percent of respondents said they would be challenged to come up with $400 to cover an emergency expense, and would likely borrow or sell something to afford it. When the Fed asked what types of emergency expenses Americans had actually faced in the last year, more than one out of five cited a major unexpected medical expense. The average expense: $2,782, or almost seven times higher than the Fed’s hypothetical $400 surprise bill."

“Many Americans remain ill-prepared for such a financial disruption,” the report asserts. “While slightly more Americans have a safety net to withstand a small financial disruption than was the case in recent years, nearly half lack the resources to easily handle such an event."