Here's How the Simpson's Predicted Donald Trump's Economic Plan More Than 15 Years Ago

By:

Fox's "The Simpsons" is the longest running American sitcom, animated series, or primetime show on television.

An episode from 16 years ago made an uncomfortably accurate guess about the current Republican presidential nominee and the political climate.

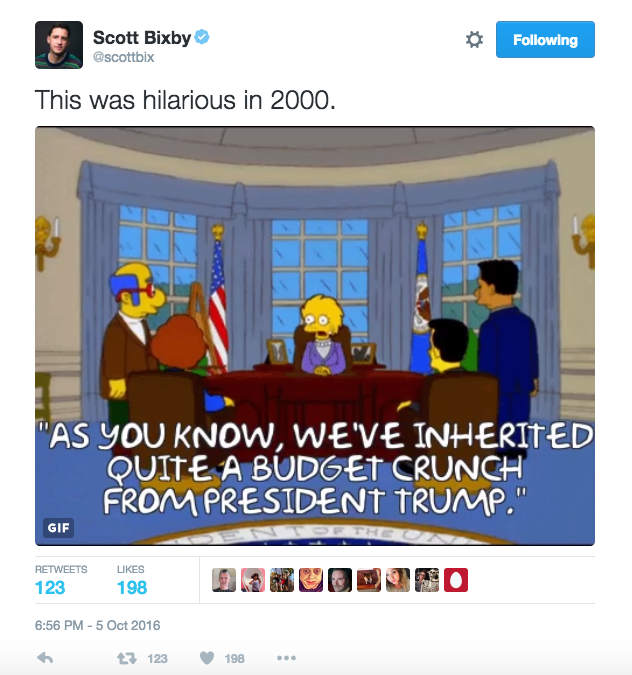

The Guardian's Scott Bixby tweeted about the episode (released in 2000) that mentions Donald Trump.

Twitter/@scottbix - twitter.com

Twitter/@scottbix - twitter.com

The season 11 episode from "The Simpsons" called "Bart to the Future" focuses on a world where Lisa Simpson has recently been elected president following a Trump administration.

In a meeting with her advisors, which includes the adult version of the character Millhouse Van Houten, Simpson asks about the state of the government's budget.

"As you know we've inherited quite a budget crunch from President Trump. How bad is it Secretary Van Houten?"

Van Houten responds with the bad news.

"We're broke!"

Simpson is shocked that the country has no money.

"The country is broke? How can that be?"

She eventually asks if there is any money for a project she promised for the public.

"What about my pledge to build the world's largest book mobile? Isn't there any money left for that?"

However another advisor steps in and says the country can't pay for that either.

"No. And we borrowed from every country in the world."

"Simpsons" writer Dan Greaney told the Hollywood Reporter earlier this year that the episode was a "warning to America."

"The important thing is that Lisa comes into the presidency when America is on the ropes, and that is the condition left by the Trump presidency," Greaney said to the Hollywood Reporter. "What we needed was for Lisa to have problems that were beyond her fixing, that everything went as bad as it possibly could, and that's why we had Trump be president before her."

While we can't see into the future to what a Trump administration would look like (there have been some predictions), we are able to look at his current economic plan — especially in regards to taxes.

A Trump advisor and entrepreneur Anthony Scaramucci, told Forbes last month that Trump's changes to the tax system will be good for the country.

"Simplify the regulations," he said in a video interview with Forbes. "And when I say lower the corporate tax rate, you can set this thing up, you can put it through the independent tax institute and make it revenue neutral just to simplification will be better than what we've got going on now, better for everybody."

He said that the Trump campaign is working on offering incentives to businesses through tax cuts as a way to create jobs.

However, Trump's plan, which was initially released in August, received strong backlash, mostly because of his plans to cut taxes and vague details about how he would make up for it.

ATTN: talked to Hunter Blair, a budget analyst from the Economic Policy Institute, who pointed to some issues in the tax aspects of Trump's economic plan.

He said Trump's plan to cut taxes would significantly increase the budget deficit. "I think the estimates are that it would increase the budge deficit by 5 trillion," he explained.

The budget deficit is the growing debt the federal government creates by spending more than the money taken in, according to the Congressional Budget Office.

Here are three parts of Trump's economic plan that could increase the budget deficit:

1. Trump wants to consolidate the seven tax brackets we have now into three brackets and make tax cuts.

Blair said that tax brackets are already a relatively simple part of the tax code.

"There's certainly benefits to maybe simplifying the tax code in general, because of how convoluted it is — particularly on the corporate side — but the tax brackets themselves are not that complicated to work out," he said.

Also the new tax brackets Trump has proposed would primarily help rich people.

"The brackets that he's offering would mostly benefit the most wealthy," he said. "The top 1 percent is getting 44 percent of the tax cuts in this plan."

2. Trump wants to reduce corporate taxes from 35 percent to 15 percent.

The Trump campaign claims that this severely reduced corporate tax rate could make the U.S. highly competitive and desirable for big companies to move into.

However Blair said big corporate tax cuts probably wouldn't help the economy overall.

"No. Economically there's basically nothing to the competitiveness argument that gets thrown around with corporate tax cuts," he said. "It's just language that makes it seem like we really need to be giving multinational corporations tax cuts."

Trump's corporate tax cuts and deregulation were a point of contention for Sen. Elizabeth Warren (D-Mass.). She tweeted in August that Trump's plan only benefits rich Americans and corporations with questionable business practices.

3. Trump wants to give small businesses tax cuts through "pass-through" business income.

Some business owners can use the "pass through" business income tax loophole to pay the personal tax rate on their business income. However expanding that practice, like Trump want's to do, would mostly benefit the wealthy.

"This is a truly terrible loophole," said Blair. "The way 'pass-through' works is that some corporations will structure themselves as partnerships or S corporations or as an LLC (limited liability company) so instead of being taxed a corporate rate the income of the business is passed through to the owners. It would just show up on your individual income tax return."

Trump's tax plan says that if someone has a "pass-through" business they will only be charged 15 percent in taxes. Blair said that this will create an "enormous incentive" for "high income individuals" to attempt to "pass through" their business income to the 15 percent rate.

"We saw a similar sort of loophole show up in Kansas through Gov. Sam Brownback and that has not worked out well," he said. "The state is hemorrhaging money because of the tax cut."

Blair said that the $5 trillion budget deficit estimate that Trump's economic plan could cause doesn't include the "pass-through" loophole, because the details on that point are still "sketchy." However that loophole could cause an additional $1.5 trillion in deficit.