Here's the Age You Need to Start Saving for Retirement

By:

With rising rents, heavy student loan debt, and an overall distrust in investing thanks to the Great Recession, it's no wonder retirement might not be a top priority for millennials.

However, we are worried about it.

Research has found that the majority of this generation is concerned social security won't be there for us by our retirement age, according to the Transamerica Center for Retirement Studies.

But this doesn't necessarily mean we're actually saving for retirement.

Only 40 percent of millennials have a retirement account, according to the FINRA Foundation. We mostly have a habit of saving in non-retirement vehicles and, as a result, can miss out on major investment returns.

How much? According to an analysis by NerdWallet, forgoing the semi-conservative 6 percent annual return of a retirement account "could cost more than $300,000 (22% of the retirement savings they could have built with a better investment mix)."

So when is it too late, if ever?

"It’s always recommended to save as early as possible because it’ll be easier in the long run – [you] won’t have to save us much money to get the same result in the end," Jessica Moorhouse, a personal finance blogger and podcaster, told ATTN: in an email interview.

So, if you wake up today and realize you need to start saving for retirement, then start saving right now. But how can you measure how far behind you are from the ideal age to start contributing to your retirement fund? Or in other words, is there an age when you're pretty much screwed?

According to Moorhouse, it's never too late, but it can get incredibly challenging to save as much money as you may need to retire if you are older. "Ideally you’d start in your 20s. If not, start saving in your 30s. If you’re just starting to save for retirement in your 40s or later, then you may have some difficulty," said Moorhouse.

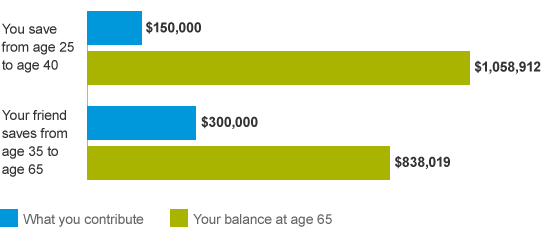

Vanguard illustrated how starting early and having more time allows you to invest less while having more to spend during your retirement (the hypothetical example is based on a 6 percent annual return and does not account for inflation):

Vanguard - vanguard.com

Vanguard - vanguard.com

The difficulty in starting late also depends on what retirement looks like for you.

If you want to maintain your current style of living, Moorhouse said "that may mean you need at least $1 million, but if you plan on moving someplace cheaper and living the rest of your days like a minimalist, you may only need half that."

As NBC reported, millennials have a tendency to have unrealistic retirement plans: "Seventy percent of millennials said they think they will spend less than $36,000 per year in retirement, according to a new survey by the Insured Retirement Institute and the Center for Generational Kinetics. Meanwhile, the average annual expenditures for people ages 65 to 74 were more than $46,000 in 2013, the Bureau of Labor Statistics found."

Beyond having realistic expectations of your expenditures, another important factor is your income: "If you’re raking in $300,000 per year at 40 years old, if you save 50 percent of your income for the next 30 years, you’ll probably be fine," said Moorhouse.

If you're nowhere near making six figures, then you might want to figure out what your retirement looks like.

You can use an online calculator that takes into account your income, your current age, amount saved so far, and the percent of your income you're currently saving to tell you how much you will have saved by the time you retire and if you're falling short of how much you'll need. According to CNN Money, "Social Security is factored into these calculations, but other sources of income, such as pensions and annuities, are not."

For example, if you are 40 years old, making $70,000 annually, and want to start saving for retirement with the hope to retire at 70, you would need to save and contribute 21 percent of your income. Comparatively, if you are 20 years old, making $55,000 annually, and hope to retire at 70 as well, you would only need to save a little more than 10 percent of your income.

If you are starting late, the personal finance blog Financial Mentor offers some catch-up strategies, such as eliminating all credit card debt, taking advantage of employer-matching retirement programs, and earning moonlighting income.