The Disturbing Way This Huge Restaurant Chain Is Screwing Its Workers

By:

Thousands of Darden Restaurants workers are being paid with prepaid debit cards, and hidden fees are digging into their take-home pay, according to a new report by a workers' rights organization.

Flickr/jeepersmedia - flic.kr

Flickr/jeepersmedia - flic.kr

An estimated 48 percent of hourly Darden workers are paid with a payroll card, according to the report. During a 2013 investigation of payroll cards by the attorney general in New York, the company — which owns a number of popular eating outposts, including Olive Garden and Longhorn Steakhouse — said the payroll cards were "a convenient way [for employees] to access their pay without incurring check-cashing fees."

But Darden workers interviewed by the Restaurant Opportunities Centers United, which authored the new report, apparently see it differently.

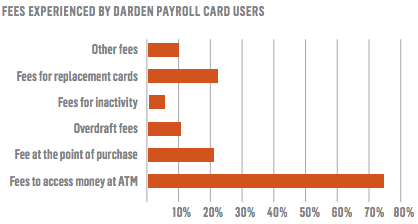

According to the report, 76 percent of workers said they had to pay fees to access their wages at ATMs, and 24 percent said they had to pay fees at point-of-purchase locations. Many others reported experiencing different fees. Some respondents said that even when they asked to get their paycheck via direct deposit, there was pushback from managers.

From the report:

"Workers can incur fees of $1.75 or more for withdrawals from an ATM and $10 for a replacement card. There is a fee of $0.75 for a declined ATM transaction and $5 for inactivity. When withdrawing from an out of network ATM, workers encounter fees from both Darden’s payroll card and the ATM provider. Darden’s payroll card charges $1.75 for out of network withdrawals while the average ATM surcharge is $2.88, bringing the total for a worker to access their wages through this method to $4.63 each withdrawal."

Rich Jeffers, a Darden spokesperson, however, told ATTN: that the ROC United report was "completely false," apart from fees from out of network ATMs and the 50 cent point-of-sales fees. He also added that on June 1, those 50 cent fees would be dropped, and that 29,000 surcharge free ATMs would be added to the existing 50,000 nationwide.

ROC United - rocunited.org

ROC United - rocunited.org

The report goes on to note that payroll card payment systems are beneficial to both employers and the card providers. Darden saves an estimated $5 million annually by using cards instead of paper checks, while banks profit from providing the cards, the report states. ThinkProgress estimates that one bank, the Federal Reserve Bank of Philadelphia, pulls in about $1.5 million each year.

"The use of payroll cards in the restaurant industry allows large employers like Darden to cut millions in administrative costs, while card companies can enjoy lucrative profits by charging workers simply to access their own wages," ROC co-founder and co-director Saru Jayaraman said in a statement.

Olive Garden - ispot.tv

Olive Garden - ispot.tv

Payroll cards have grown in popularity in recent years, especially for large restaurant and retail chains. Last year, an estimated 7.4 million workers nationwide received payroll cards. By 2019, that number is expected to swell to 12.2 million, according to the business research firm Aite Group.

"The biggest, most important thing is 50 percent of our employees choose this option," Jeffers said, referring to the payroll cards.

"That should speak for itself," he added.

ATTN: reached out to ROC United and will update accordingly.