Here's a Powerful Congressman with a Bold Plan to Help the Middle Class

By:

We're only one month into this new Congress and still a long way from the presidential election in November 2016, but it already seems like we know the biggest question that will face lawmakers and voters for the next 21 months: What's the best way to help the middle class?

This issue was the general theme of President Obama's State of the Union address. It's also the focus of top Democrats in Congress. Rep. Chris Van Hollen (D-Md.), the senior Democrat on the House Budget Committee, has a tax proposal that would boldly tilt the tax system to favor working and middle class people. Unfortunately for Van Hollen and his party, Republicans currently control Congress and aren't likely to pass anything like what Van Hollen and President Obama have proposed. But it's worth looking at Van Hollen's plan because it is an indication of what we will hear from Democrats over the next two years.

Van Hollen's primary message? Americans need a raise.

"These are proposals that are designed to incentivize businesses to increase pay," Van Hollen told ATTN. "This is a plan that has broad appeal and broad benefits."

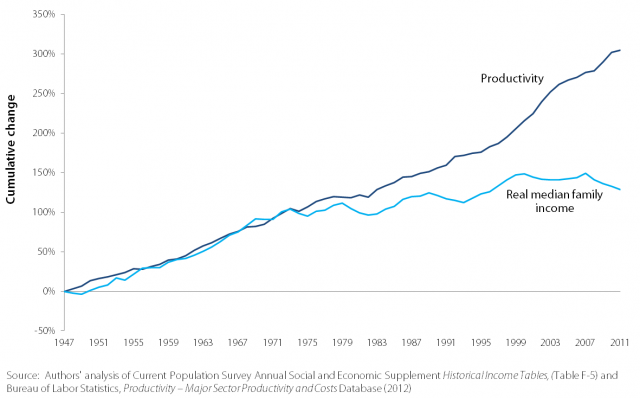

His plan tackles wage stagnation, a problem that has plagued the middle class since the 1980s. Wage stagnation is pretty simple -- it means that paychecks are not increasing at the same rate as worker productivity. Since 2009, wages have barely kept pace with inflation.

Van Hollen hopes the allure of tax breaks conditioned on offering workers higher salaries will compel companies to increase pay. Under Van Hollen's plan, to take advantage of tax deductions for executive compensation, businesses will have to increase wages as well as offer stock options and profit-sharing opportunities to all employees.

"The current tax code provides incentives for things like corporate jets and racehorses," Van Hollen said. "So we should also have incentives in our tax code that encourage corporations to have pay raises for employees if the top executives are deducting these huge, multimillion-dollar bonuses."

He also proposes an income tax credit that would provide middle class workers with an extra $1,000 each year. For workers willing to invest half of that $1,000 tax credit into a tax-deferred savings plan, there's an additional $250 bonus. According to Van Hollen, young people who take advantage of this program throughout their careers could build as much as $200,000 in savings.

So, how would we pay for all of this?

The plan has two payment mechanisms. The first would be to limit tax breaks for wealthy Americans. To do that, Van Hollen proposes that the tax code be changed to benefit fewer people who make money from investments and benefit more people who work for a paycheck. The second would be a small fee on financial market transactions. Interestingly, this fee would have the added benefit of curbing high-frequency trading, which many experts believe is not good for financial markets.

"The tax code is currently structured in a way that disproportionately favors those who are making money out of money and works against people who are making money out of hard work," Van Hollen said. "We're proposing that we look at the tax code and recognize that the top 1 percent of income earners are actually getting 17 percent of the tax breaks. That's a skewed tax code."

Want a more information on Rep. Van Hollen's plan? Here's a breakdown:

1. $1,000 extra per year ($2,000 for a married couple) from a Paycheck Bonus Tax Credit.

How it would work: If you're earning a paycheck and paying taxes, you'd get this yearly bonus of $1,000 (or $2,000 if married). It would phase out at an income of $100,000 per individual ($200,000 per working couple), indexed for inflation.

2. $250 extra per year from a Saver's Bonus.

How it would work: For workers that commit at least $500 of the above Paycheck Bonus Tax Credit or the already existing Earned Income Tax Credit to some sort of tax-deferred savings plan (such as an IRA), the government would send you an extra $250. The logic? This would encourage people to save for retirement at an early age because they'd be getting $250 to save their money.

3. Higher wage jobs.

- CEO Paycheck Fairness. This would force corporations to raise the salaries of their existing employees if they want to continue benefiting from certain tax breaks.

How it would work: Right now, corporations can claim tax deductions for executive salaries up to a limit of $1 million, but, in reality, this limit is pretty flimsly because they can deduct an unlimited amount as long as anything over a million bucks in salary is called a "bonus" or "performance pay." Van Hollen's plan would make that $1,000,000 limit much stronger and prevent companies from deducting anything over a million....unless their workers are getting salary increases that keep pace with inflation and increases in productivity. So, the idea here is that companies who pay their workers more get to benefit from a tax deduction.

- More salaries that include stock and bonuses.

How it would work: If a company wants to use certain tax breaks for executive pay, this would require that they also provide some sort of stock option plan or profit-sharing plan to all employees, not just top executives. Conditioning these tax breaks around more stock and bonuses for more employees would increase the amount of workers with the opportunity to participate in these plans.

5. More companies paying for your job training.

How it would work: Provide tax credits to businesses that have apprenticeships or other job training partnerships. The idea here is that, instead of searching for employees that are already trained, companies would have a tax incentive to hire a good person, get them on salary, and train them on the job. It would mean that you'd have the security of a paycheck every two weeks while learning something new instead of training yourself on your own while unemployed.

Rep. Van Hollen says this plan could be paid with increased tax revenue from two changes:

1. Limit tax breaks that benefit wealthy people who earn their money through investments instead of a paycheck.

2. Add a small fee to all stock transactions similar to what already exists in Europe.

If you want even more on Rep. Van Hollen's plan, here's the official fact sheet.