Here's How Much Money You Need to Live in 50 American Cities

By:

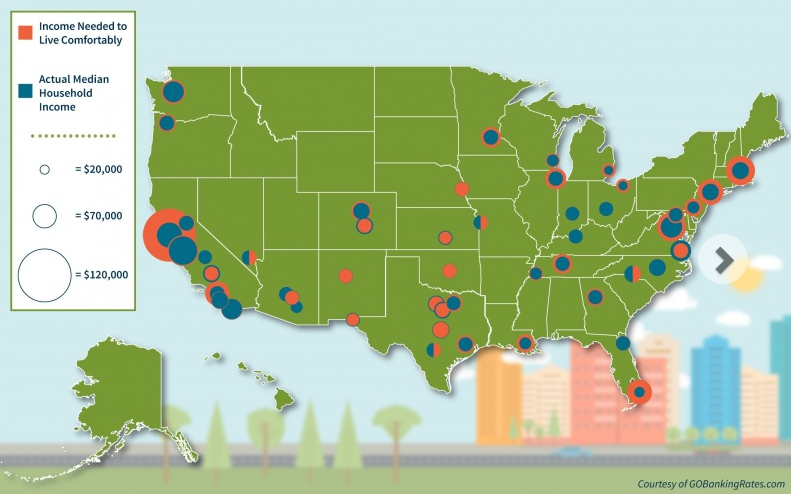

Most American Millennials cannot afford to live comfortably in the 50 most populous cities in the U.S., according to average Millennial income estimations and a new map of average comfortable living expenses compiled by the personal finance site GOBankingRates.

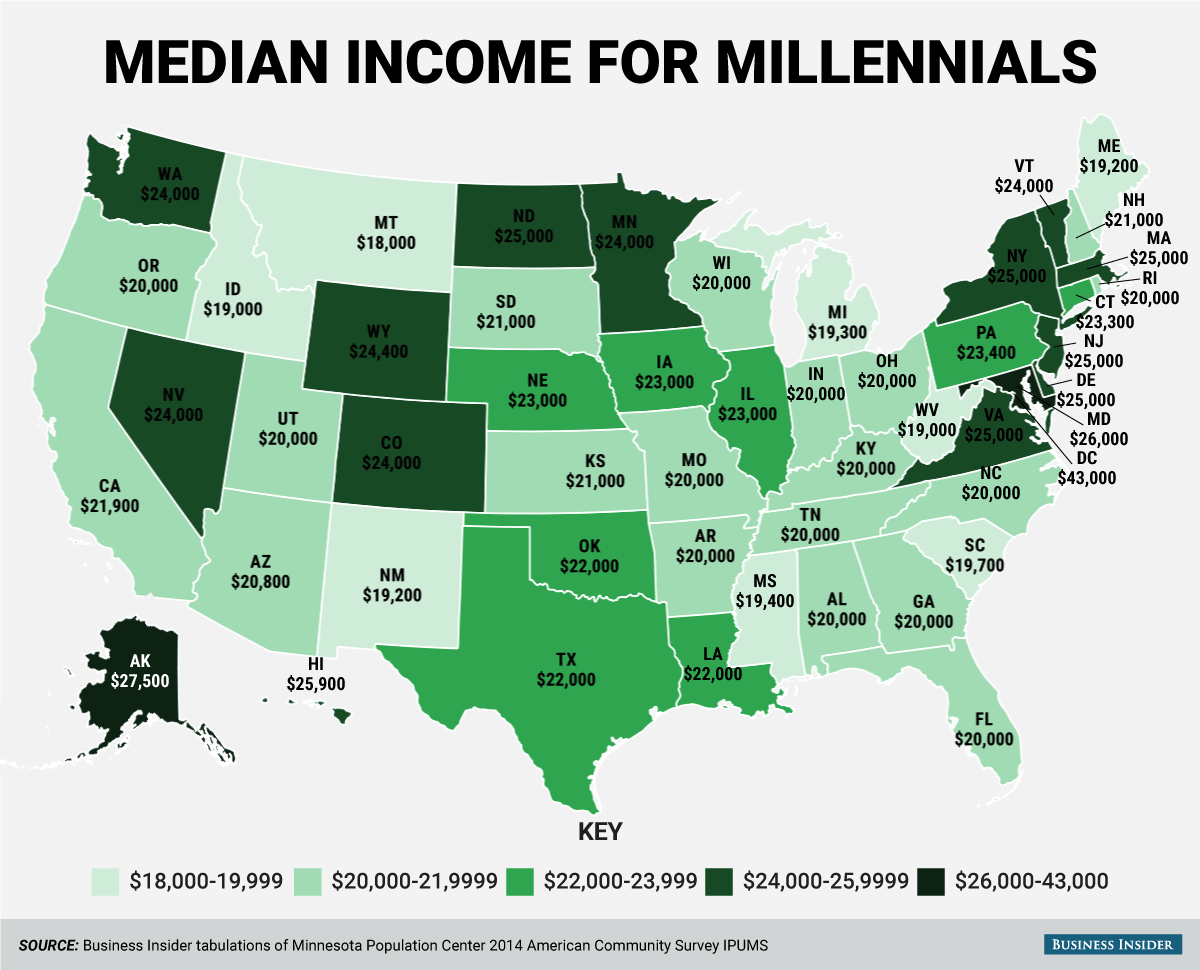

Millennials in the U.S., those born between 1981 and 1997, make a median annual income of anywhere between $18,000 and $43,000, according to data from the Minnesota Population Center's 2014 "American Community Survey" in the Integrated Public Use Microdata Series (IPUMS).

But according to GOBankingRates' estimates, Millennials on average are coming up short when it comes to what is needed to live comfortably in parts of the United States.

GoBankingRates - gobankingrates.com

GoBankingRates - gobankingrates.com

For each of the 50 most populous cities, GOBankingRates added up the dollar amounts of living expenses like rent, groceries, utilities, transportation, and healthcare, from Census Bureau and other agencies' data. They then doubled that number to find out how much a single person might need to live there. They plugged that number into the 50-30-20 budget formula — where 50 percent of your income covers necessities, 30 percent covers discretionary spending, and 20 percent is dropped into savings — to arrive at the amount needed to live comfortably in a given city.

Back in December, Business Insider compiled median Millennial income data from the IPUMS data across all 50 states.

Business Insider - businessinsider.com

Business Insider - businessinsider.com

The disparity between average income and cost of comfortable living is stark in most of the 50 most populated cities. There are, however, lots of variables when it comes to calculating average costs of living, as well as estimating how much money more than a quarter of the nation's population is making. For instance, what standards designate a "comfortable living," how accurate are average rent estimates, and how can income averages for millions of Americans, many of whom are still college-age, and many more still who hold high-paying jobs in emerging industries, be accurate?

Those factors and more present a decidedly more complex picture of how affordable the 50 largest U.S. cities, but the two maps nonetheless highlight one aspect of the housing affordability crisis — especially for the nation's lowest income renters.