Where Is Student Debt the Worst?

By:

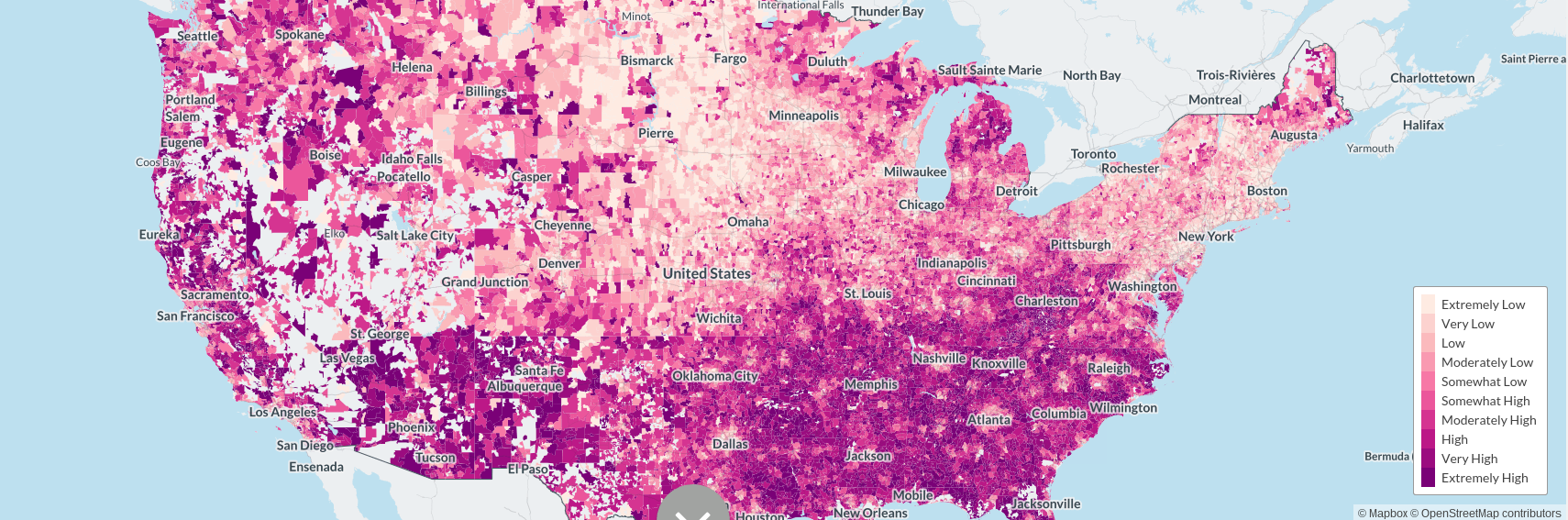

Marshall Steinbaum and Kavya Vaghul of the Washington Center for Equitable Growth put together an interactive map showing where student debt is the worst in the U.S.

The Washington Center for Equitable Growth, which partnered with the progressive public policy research organization Center for American Progress for this project, compared "zip code-level data on average household student loan balances and delinquency to zip code median income" to highlight the geography of student debt in America. The researchers used credit reporting data on student debt from credit bureau Experian and income data from the American Community Survey to create this map. Though the map below isn't interactive, you can go to MappingStudentDebt.org for the interactive features.

RELATED: Hillary Clinton Has A Bold Plan To Tackle the Student Debt Crisis

Mapping Student Debt / The Washington Center for Equitable Growth - mappingstudentdebt.org

Mapping Student Debt / The Washington Center for Equitable Growth - mappingstudentdebt.org

The map indicates that much of the South faces extremely high delinquency—which is defined by Investopedia as when "an individual or corporation with a contractual obligation to make payments against a loan in a timely manner, such as through a mortgage, but payments are not made on time." In other words, a borrower is late or overdue on paying back a loan.

Pockets of the West Coast and Southwest have high delinquency rates as well. Many parts of the Midwest, such as Ohama, Fargo, and Milwaukee, have extremely low delinquency rates. Total student debt in the United States has reached $1.3 trillion. The average student loan balance has also increased to nearly $30,000, a big jump from $23,000 in 2008, according to Experian.

ALSO: Two Supreme Court Cases Could Change Student Debt In a Big Way

The researchers came to three major conclusions from the data in the above map: "Affluent zip codes have high average student loan balances per household," "Higher delinquency afflicts low-income zip codes, and "Within metropolitan areas, the geography of loan balances is very different than the geography of delinquency."

In metropolitan areas such as Chicago and Washington, D.C., for example, high-income zip codes have high loan balances, but low-income zip codes are most impacted by delinquency.

"For the country as a whole, there’s an inverse relationship between zip code income and delinquency rates," Steinbaum and Vaghul wrote. "As the median income in a zip code increases, the delinquency rate decreases, corroborating findings that low-income borrowers are the most likely to default on their loan repayments."

ALSO: PAYING FOR COLLEGE IS NOW HARDER THAN PAYING OFF A HOME

As ATTN: has noted before, student debt isn't just a drain on those paying off their loans, but the economy at large, and that is why they've become everyone's problem. Student loan debt, which impacts 40 million Americans, lowers consumer spending and in turn hinders the housing market, as people with major debt are less likely to buy a home and other big purchases. According to a 2013 Bloomberg report, the majority of people with student loan debt are under 40 and couldn't take advantage of lowering housing costs two years ago because of their debt.

“Student debt has a dramatic impact on the ability to buy a house, and to buy the dishwashers and the lawnmowers and all the other purchases that stem from that,” Diane Swonk, chief economist of Mesirow Financial, told Bloomberg in an interview. “It has a ripple effect throughout the economy.”

In an ATTN: piece published earlier this year, Dante Atkins noted that this lack of participation has consequences.

"Let’s say you have debt, but you’re not even looking to buy a house," Atkins wrote. "You just want to rent your own an apartment, but you can’t even do that because it’s not affordable—so you end up splitting a place with roommates or moving back into your childhood bedroom. You may not think that hurts the economy—but really, it does."

ALSO: ELIZABETH WARREN EXPLAINS WHY STUDENT LOAN DEBT IS SUCH A MESS

Editor's note: An earlier version of this story misstated that the Washington Center for Equitable Growth is part of the Center for American Progress. These are two different organizations, and they merely partnered together for this project. ATTN: regrets this error.