Martin Shkreli Is at the Center of yet Another Sleazy Controversy

By:

Turing Pharmaceuticals CEO Martin Shkreli is at the center of yet another controversy — but this time it isn't related to Daraprim, the life-saving drug that his company acquired in September, raising the price 5,000 percent overnight.

RELATED: Martin Shkreli Won't Lower the Price of Daraprim After All

Instead, it's about Shkreli's role in an alleged share price manipulation at KaloBios, another drug company that recently named Shkreli CEO after he led a group of investors to acquire 70 percent of the company.

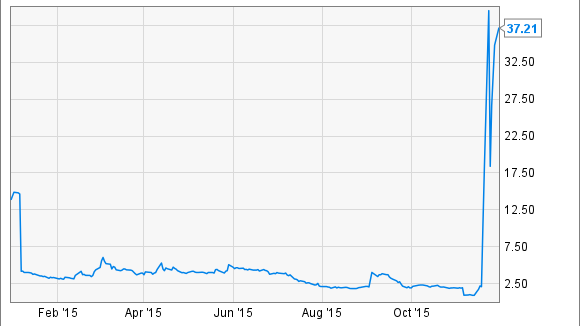

On November 19, the day that Shkreli become CEO of KaloBios, the company's shares quintupled in price, from $2.07 to $10.40. They rose as high as $39.50 over the following days. That was bad news for short-sellers of KaloBios. Short-sellers are traders who borrow shares of stocks that they expect to decline in price, sell them, and then later buy stocks once the price goes down to replace the borrowed shares and, ideally, profit.

Here's a graph showing the price change for KaloBios shares this year.

The Los Angeles Times - latimes.com

The Los Angeles Times - latimes.com

"Some market observers see signs of a deliberate short squeeze, in which short-sellers are forced to buy frenetically to limit their losses, in these numbers," the Los Angeles Times reported. "Some are even comparing it to the most celebrated short squeeze of all, a 2008 rally executed by Porshe in Volkswagen shares that briefly made Volkswagen the world's most valuable company and may have extracted as much as $15 billion from investors on the short side."

Then, on Thanksgiving, Shkreli wrote on Twitter that he was going to stop lending his KaloBios shares "until I better understand the advantages of doing so," and the company's stock price spiked when trading resumed on Friday. It went up to $34.83 from $26.63 per share.

"One trader got so whipsawed that he launched a GoFundMe campaign for donations to cover a trading account that went from $33,000 in the black to a crushing debt of more than $106,000 in two days. (He raised a bit over $5,000.)," according to The Times.

As far as the pharmaceutical executive is concerned, however, the rise of KaloBios stock price is nothing out of the ordinary.

"This was a company on death's door and it was rescued by a well-known investor," Shkreli said, referring to himself. "Would you expect it to go down?"

RELATED: Martin Shkreli Won't Cooperate in Federal Investigation

But some analysts say that Shkreli is deliberately manipulating share prices, and they have implored the U.S. Securities and Exchange Commission to investigate. A Forbes article recently criticized the SEC for sleeping through the short-selling scandal, writing that "hapless shareholders standby and get screwed one way or another, with the SEC thus far seemingly just watching the fun and games."