The Surprising Reason You and Your Friends Aren't Saving Money

By:

It is hard to save money, and according to researchers, Millennials may have it the worst. Millennials are the generation, after all, who were just starting out in the workforce when the Great Recession hit.

As a result, many of them don’t trust banks and know little about how to manage their finances. One study done by the University of Oxford and BNY Mellon found that the financial literacy rate for Millennials in the U.S. as well as Australia, Brazil, China, Japan, the Netherlands and the United Kingdom is very low. Half of the Millennials were found to not understand how pensions operate with the majority saying it was unclear to them how tax advantages and compound retirement savings benefits work. This aligns with a recent Harvard study that said only 11% of Millennials trusted Wall Street, which includes many of the financial institutions that manage the savings of Americans.

The study also indicated that Millennials are twice as likely to seek financial advice from their parents instead of a banking institution.

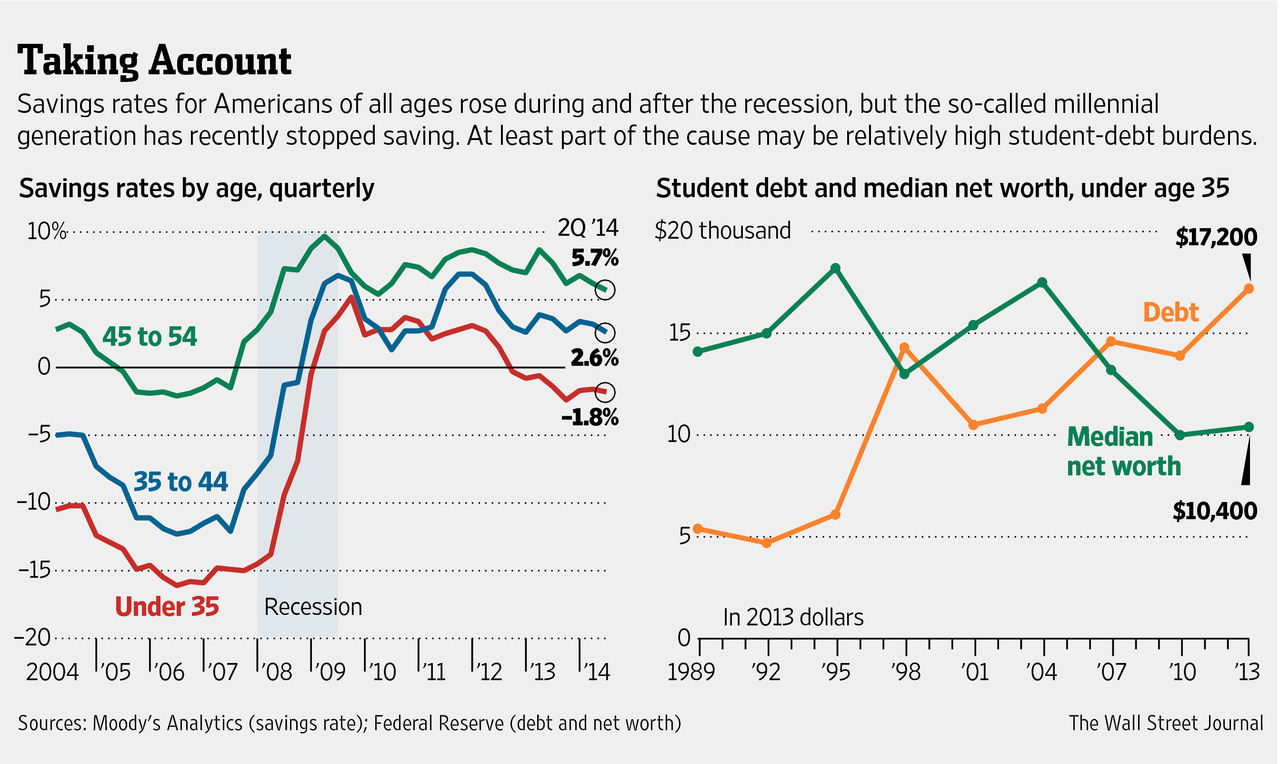

As a result of the lack of financial wisdom, coupled with, in some cases, crippling debt, Millennials’ savings have suffered. The Wall Street Journal reported last month that adults under 35 save at a rate of minus 2 percent, according to Moody's Analytics. In 2009, the savings rate of the same age group was 5.2 percent, according to the report. Many Millennials are, unfortunately, facing big student loan debt with the average debt being around $27,000.

Research by Wells Fargo Bank showed that 47 percent of Millennials spend around half of their paychecks toward their debts. Mortgage and credit card debts also factor into the equation.

Is there a solution?

The statistics are startling given that Millennials represented about one-third of the U.S. population last year, according to WhiteHouse.gov. What is the solution?

Better access to financial information might be one place to start. An increasing number of online offerings has made educating yourself that much easier, with companies like LearnVest, which was founded by a Millennial, Mint.com and YNAB.com (You Need a Budget.com) jumping on the bandwagon.

I’ve found monthly automatic savings debited from my checking account to be one of the easiest ways to save on a consistent basis. In addition, my mother has struck fear into me regarding saving by reminding me that my maternal grandmother, who had no college education, saved some money every week even if it were only a few dollars…something to consider.

Do they have enough money anyway?

Millennials are also making les money because they are working in industries where pay is declining. That includes many industries where employees do not have college degrees. Like many Americans, Millennials are working in minimum wage jobs that barely allow them basic necessities, let alone provide them enough money that they can set some aside for a rainy day.

Raising the minimum wage and creating more good jobs for young Americans would also go a long way toward improving overall financial well-being and make it easier to start saving.