5 Hidden College Costs That Should Be on Your Radar

By:

Skim through the site of the university or college near you. Look beyond the staged photos of ecstatic, productive-looking co-eds in branded sweatshirts and hats. Make your way through admissions to the buried tuition page, and if necessary, click even further into the linked PDF detailing what tuition actually is for this school year. And yes, your bank account will cringe just by glancing at it before you click away. That might not be the real cost though—there are some hidden expenses, too.

There is no doubt that a college education is a worthy endeavor. It engages the brain, challenges intelligence, forces you to write papers on topics you would otherwise never consider, and collaborate on projects with people you never would have met before; plus, no one can ever take what you learn away from you.

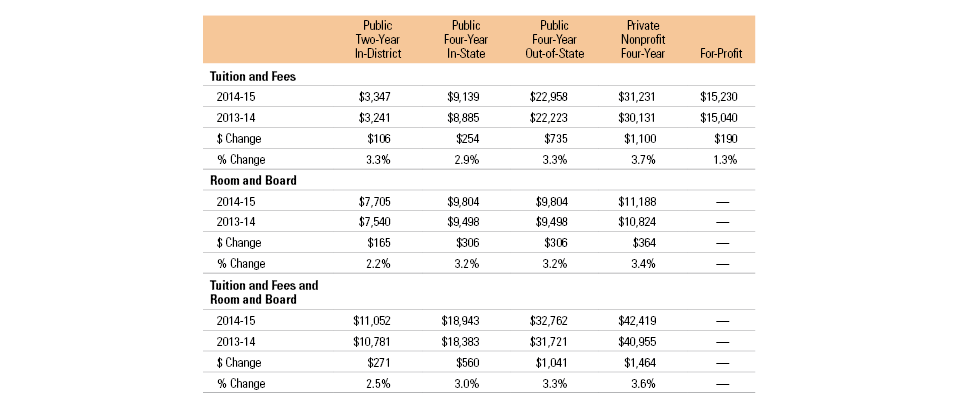

Formal higher education is the embossed stamp of approval that you are qualified to enter into the workforce with a certain level of knowledge. That embossed stamp clearly comes with a cost. A cost that has increased 500 percent since 1985. Students at Sarah Lawrence College, known as the priciest college, pay $65,480 a year and understand, as do the collegiates at Harvey Mudd College, in Claremont, California, who shell out $64,427 annually. Those are the top of the heap but still the average cost for a four-year college for 2014-2015 rose 2.9 percent over the year prior—more than $9,000 for a public four-year in-state institution and upwards of $31,000 for a private four-year school, according to the College Board.

The College Board - collegeboard.org

The College Board - collegeboard.org

Although financial aid, grants, and scholarships are available to help knock tuition prices down, it might not be enough for some students to cover the costs, including the unexpected ones. Here are five things to consider when price-shopping for schools.

1. Food

College food is pricey, convenient, has a captive audience, and little to no competition. As student demand for better ingredients, more choices, diverse offerings and late night hours have increased, so has overall price.

The actual price can be difficult to breakdown as “room & board” are often lumped together as a single line item on the semester total breakdown. Dependent on where you live and what you eat, the average cost of a meal ranges on average from $7 to 11. (You can buy a lot of ramen packs for that price.) Use this tool to calculate the per-meal cost.

Evaluate how much you eat and your mealtime habits. Are you more a five-time-a-day small meal muncher or big breakfast eater?

Many underclassmen aren’t given the opportunity to escape the meal plan trap altogether as living on-campus and having a meal plan are required. Begging the question of which tier of meal plan and what sort of on-campus eating opportunities are preferable for your lifestyle. If you plan to eat on-campus all the time an unlimited plan is likely your best bet when broken down per meal. And, it can often actually prove to be a money-saver to invest in a meal plan as opposed to paying cash for each meal.

If you can live off-campus and do your own cooking more often than not, choose a lighter meal plan and brownbag those lunches like a boss.

Consider if unused meals can be rolled over, if dining hours fit with your schedule, if sales tax is included and if the plan accommodates for your diet (ethnic foods, vegan meals, vegetarian options).

2. Class Fees

“Tuition & fees” as listed on the cost breakdown for schools probably fail to incorporate the extraneous costs for materials or technology. So, get the full price scoop before registering for the pottery class or consider any tech software costs that may accrue for the online economics course. Be wary that excited professors may suggest more gadgets then necessary. For example that video gear for journalism class may not actually be needed and if so, could be checked out of the tech library/closet.

3. Greek Life

The brotherhood and sisterhood offered by fraternities and sororities can be incredibly attractive as organizations that offer events, philanthropy, and an instantaneous network of people connected around similar values. More than 725,000 students are part of a collegiate social Greek organization. While it may seems like everyone on the dorm floor is going through recruitment, know that this social network can offer a lot of benefits, but also cost a lot of money. The fees can add up quick: $50 recruitment fee, first semester dues and initiation charges. Then after you’re in the organization there are the “not mandatory but highly encouraged” t-shirts, tickets to attend formals, large amounts of money spent on gifts for “littles” and charges for missing weekly chapter.

Be honest with yourself when going through recruitment. If the financial information is not presented forthright don’t be afraid to ask. It is better to know if you can handle the extra financial cost before you join rather than having to quit due to monetary strain.

4. Transportation

Depending on where you go to school it’s likely you will need to factor in transportation. Whether it’s taking public transport or bringing a car to college, financially it can crash your budget. College parking lots often require a purchased pass every semester. Beware that parking in that spot (that’s not actually a spot) because you are late to class again can result in extra parking tickets that rack up fast.

If you’re going to pursue an internship or part-time job off campus you may need a vehicle, but weigh this with the costs that come with gas, repairs and insurance.

Best bet: live near or on campus and invest in a bike or live near a bus route.

5. Books

Almost every class will demand backpack full of books used throughout the course and they will need incredibly specific editions, meaning you have to buy the exclusive new one from the campus bookstore as opposed to the used highlighted version off of Chegg. Unlike high school, books are not provided in college and it adds up to an average of $1,200 per year at four-year public universities for full-time students. Lower the cost by renting or book sharing. Just be sure to obtain the right edition because you can be sure that one chapter that’s not in the previous text is what you’ll be tested on.