Student Loan Complaints on the Rise

By:

A new report from the Consumer Financial Protection Bureau (CFPB) shows that complaints about student loans are on the rise.

Stocksy/Sean Locke - stocksy.com

Stocksy/Sean Locke - stocksy.com

While complaints actually decreased 30 percent from February 2017 to March, that wasn't enough to offset a huge annual increase in complaints. In the three month period measured (January 2017 to March), student loan complaints increased 325 percent over the same time last year.

That's in part due to the fact CFPB now counts complaints about federal loan servicers. But even still, complaints overall are way up, most commonly about issues with lenders or servicers (64 percent), not being able to repay a loan (33 percent), or problems getting a loan (3 percent).

Student debt totals about $1.4 trillion dollars, and the average student debt borrower owes $36,000, according to Consumer Reports.

Borrowers are having trouble repaying this massive debt and one-fourth of the 44 million borrowers in the U.S. are late on payments or in default.

Federal student loan borrowers also complain that their loans were incorrectly reported, that they were given unclear guidance and misinformation about beneficial programs (such as income-drive repayment plans), and that they received "insufficient information from their servicers to meet recertification deadlines and lengthy processing times."

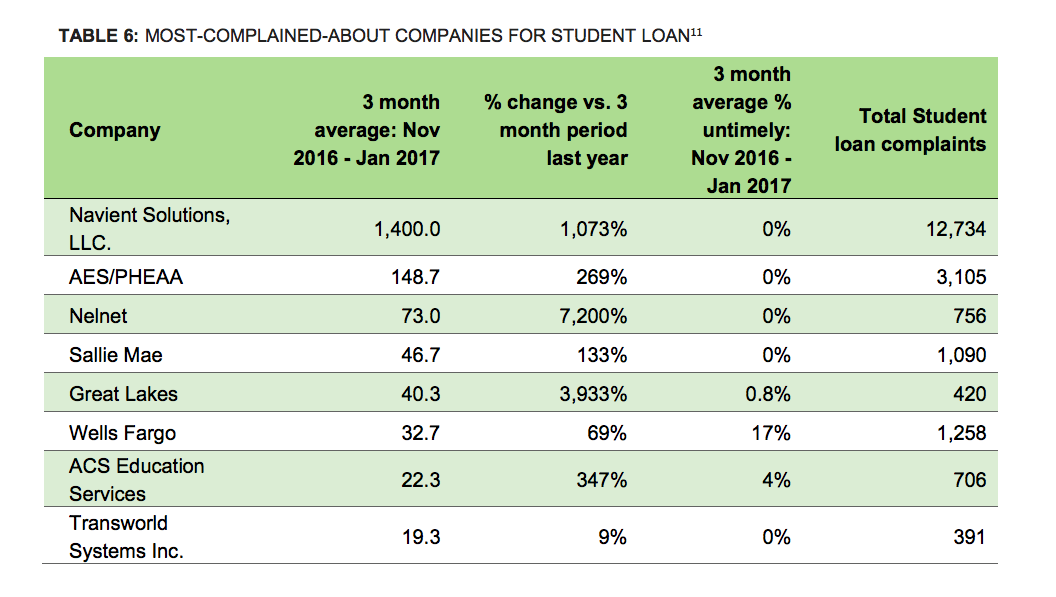

The majority of these complaints were about one private loan company: Navient Solutions, which services more than 12 million borrowers.

CFPB - consumerfinance.gov

CFPB - consumerfinance.gov

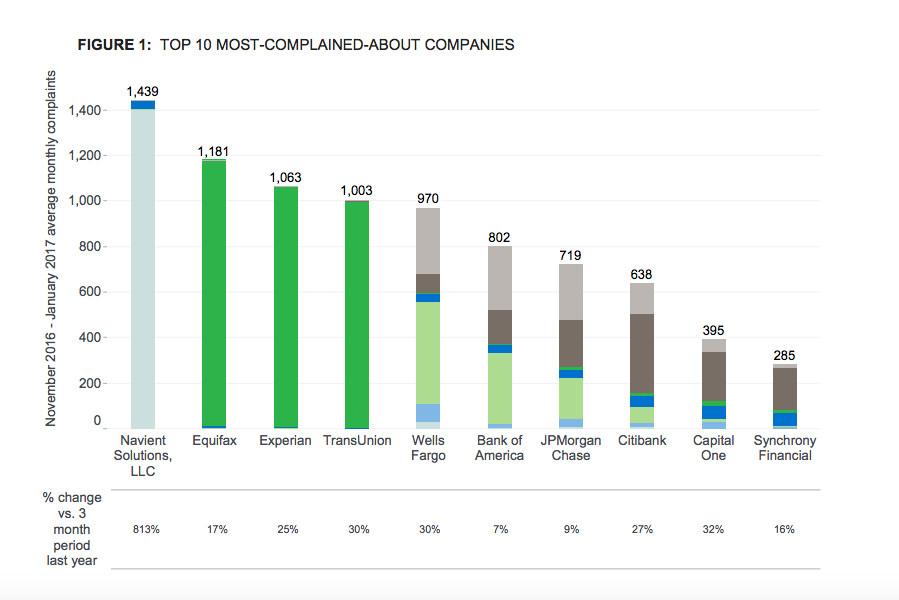

In fact, Navient was not just the most complained about student loan company, but also the most complained about company, period.

CFPB - consumerfinance.gov

CFPB - consumerfinance.gov

As ATTN: reported inJanuary, CFPB has filed a lawsuit against Navient alleging that it systematically cheated borrowers. Navient is accused of giving borrowers bad information, making it more difficult to enroll in cheaper repayment options, processing payments incorrectly, and ignoring complaints.

Whatever the company, paying off debt might get even harder. As ATTN: reported, President Trump has revoked an Obama-era memo that prevented debt collectors from charging higher interest on overdue student loan debts. Education Secretary Betsy DeVos also revoked a 60-day grace period, which allows students behind on payments to avoid a 16 percent fee on their loan balance.

Unfortunately for borrowers, it looks like there will be plenty of reasons to complain going forward.