People Are Roasting This Budget for 'Poor' Rich People

By:

A blog post from the personal finance website Financial Samurai is getting a lot of heat for trying to make readers sympathize with couples who "scrape by" on $500,000 a year.

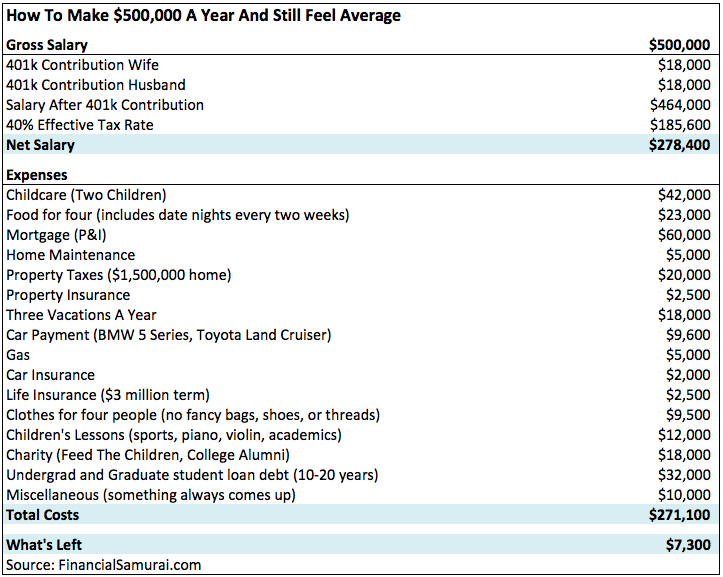

The budget, included in an article titled, "Scraping By On $500,000 A Year: Why It’s So Hard For High Income Earners To Escape The Rat Race," is supposed to illustrate how one can make a half-million dollar salary but still feel "poor" living in Manhattan. The title alone infuriated people, as the national average salary in 2015 was reported to be $48,098.63 by the Social Security Administration, with many making make far less.

Here is the hypothetical budget of a typical lawyer couple in NYC, who each make $250 thousand a year to illustrate how the rich can "still feel average":

Financial Samurai - financialsamurai.com

Financial Samurai - financialsamurai.com

Joshua Brown, a financial advisor and CNBC commentator, tweeted the budget:

Brown jokingly suggested that's a sacrifice that New York's rich would never dare make:

(Again: he was joking.)

But Financial Samurai argues this budget, and the problem it purports to highlight, is serious.

"[M]oney can be intoxicatingly evil once the big bucks start rolling in," the blog states. "As soon as you start making multiple six figures, you begin associating yourself with other people who make similar amounts or much more ... There’s a never ending cycle of financial comparison. And with comparison comes envy, jealousy, depression, and all sorts of ridiculous feelings that would not be felt if you just took a step back and realized how fortunate you really are. This is why if you do want to beat the Joneses, you should compete on FREEDOM because there’ll always one more dollar to be made."

The author then segues into a section called, "All The Pushbacks Addressed." There they add: "I’m sure by now many of you are wondering what the heck is wrong with this couple? How could they earn so much money and be left with so little. Here are your most common responses and some further thoughts."

Spoiler alert: The writer argues most of this spending is reasonable. "Pushback #6: Three vacations a year? What a joke!" Not so fast: "It’s sad that we view having three, one week long vacations a year in America as a difficult thing to do. Spend some time working in Europe or Asia and you’ll discover how little vacations Americans actually take. Is there any wonder why countries in Europe, despite their high taxes, consistently rank as the happiest countries in the world?"

None of these responses reflect the current mood of many in the U.S., where most people would love to be "scraping by" on a six-figure salary. But the author suggests the richer you are, the more stress you're under:

"High Income = Lots Of Stress

If you’re making $500,000 a year in household income as a worker bee, you’re probably going through a lot of stress due to the amount of hours you are working plus the amount of taxes you are paying. Society won’t acknowledge the sacrifices you made, the time and money you spent, and the risks you took to get to your position today.

Is there any wonder why money doesn’t buy happiness?"

Actually, The American Psychological Association has reported the opposite is true: the lower your socioeconomic status, the higher your stress: "Higher rates of job dissatisfaction and job-related stress have been observed in workers with more frequent overtime requirements, little managerial support, and less work flexibility."

And as this tweet points out:

Lower-class and even middle-class families are increasingly finding their needs are not being met by their incomes, as the public policy think tank Demos reported in 2013:

"The difference between now and the past era is that the threat of economic insecurity is no longer a persistent problem of just the poor. Economic insecurity has become the ongoing condition of far too many U.S. households. In 2010, less than one in three American households (32%) reported having sufficient emergency funds, down from 38% in 2007. In the 2007 Survey of Consumer Finances, 19 percent of working-age households reported having no assets or negative wealth. By 2010 that figure had risen to 33 percent, the highest percentage since 1989, the first year for which consistent data is available."

In conclusion: People who are truly struggling to get by aren't going to have much sympathy for the wealthy couple booking their third vacation of the year.