What Would Happen If Americans Boycotted Student Debt?

By:

Would a student loan boycott be an effective form of protest against President Donald Trump?

An article published in The Nation on Tuesday offers that very advice. Don't just resist his administration through protest, argues author Ravi Mangla, disrupt it by collectively refusing to make payments on student loans in an effort to distract him from his agenda.

AP/Ross D. Franklin - apimages.com

AP/Ross D. Franklin - apimages.com

The boycott would serve a dual purpose, Mangla wrote. First, it would "force the government to reckon with the full weight of our broken loan system" and second, it would "command the attention of the federal government and help impede President Trump from implementing parts of his agenda."

While the plan may sound intriguing to Trump-opponents burdened with debt, student loan experts are skeptical about this approach.

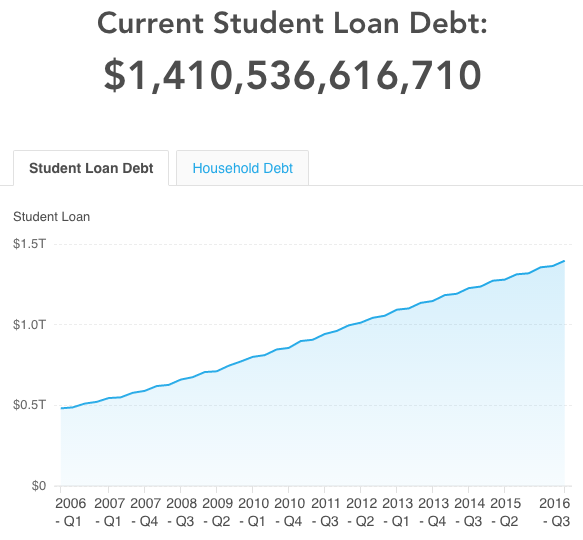

Student debt is growing issue. The average college graduate left school with $30,100 in student loan debt in 2015, according to The Institute for College Access and Success. And as Mangla pointed out, there are now about 45 million Americans with student debt, which amounts to more than $1.4 trillion; the majority of that debt "is held by the federal government," which offers student loans at a lower interest rate than private loan providers.

Market Watch - marketwatch.com

Market Watch - marketwatch.com

But what would actually happen if millions of Americans with federal student loan debt stopped making payments?

Joshua Cohen, a student loan lawyer based in Vermont, expressed serious doubts about the prospect of a student loan boycott influencing federal education policy. He told ATTN: that it doesn't take much effort for the U.S. Department of Education to garnish wages, deduct Social Security, and skim from tax returns from individuals who default on their student loans.

Stocksy/Carolyn Laguttuta - stocksy.com

Stocksy/Carolyn Laguttuta - stocksy.com

"They are hoping that it is so hard, so difficult, and so administratively infeasible to do massive amounts of wage garnishment and Social Security offsets that the administration falls apart and can't actually follow through on it," Cohen said. "The problem is, I don't think it's that hard. They send them out to debt collectors, and debt collectors are making 25 percent off of this — so of course they're incentivized — they're going to get the letter out to the employer, and when the employer sees it, most of them say, 'Oh okay,' and they just do the wage garnishment."

He did, however, offer an alternative to the boycott that he thinks might be more effective at putting pressure on the government to address college affordability: Apply for federal income-based repayment (IBR) programs. People enrolled in income-based repayment plans typically pay about 10 to 15 percent of their gross adjusted income every month toward their student debt.

"Quite honestly, I bet their IBR payment is less than their wage garnishment," Cohen said. "Now you're choking the government the way you want to and you're doing it legally."

A hypothetical boycott also hinges on at least two factors, as Mangla said — leadership and follow through.

"No one will jump unless they know we’re all jumping together," he wrote. And the risks of taking that jump — garnished wages, Social Security cuts, and bad credit — without a guarantee that a boycott would achieve anything in the way of policy reform is simply too large an obstacle to overcome, Cohen said.

"Even if people could organize and they did this on a massive thing, I don't think it is going to have a huge policy [impact] because, again, as long as the money is coming in, who's suffering?" he said. "You're also talking about a new leader who has no problem filing bankruptcy. He has no problem finding other ways to maximize profit at the expense of others."