What Trump's Tax Plans Mean for You

By:

Now that we know Donald Trump is on his way to the White House, a lot of people are wondering how their tax bills are going to change, where the money's going to go, and how the economy might change in general. Trump famously said he's going to deliver a tax plan that's going to cost him a fortune, as a rich person, but some aren't so sure.

“I am willing to pay more, and you know what, the wealthy are willing to pay more,” Trump told ABC’s This Week in May. “The middle class has to be protected,” he told NBC at the same time. “The rich is probably going to end up paying more.”

That said, his actual tax plan doesn't appear to follow what he's said.

Trump's plan

"If you look at the most wealthy, the top 1 percent would get about half of the benefits of his tax cuts, and a millionaire, for example, would get an average tax cut of $317,000," Lily Batchelder, a law professor at New York University and visiting fellow at the Tax Policy Center, told NPR this week.

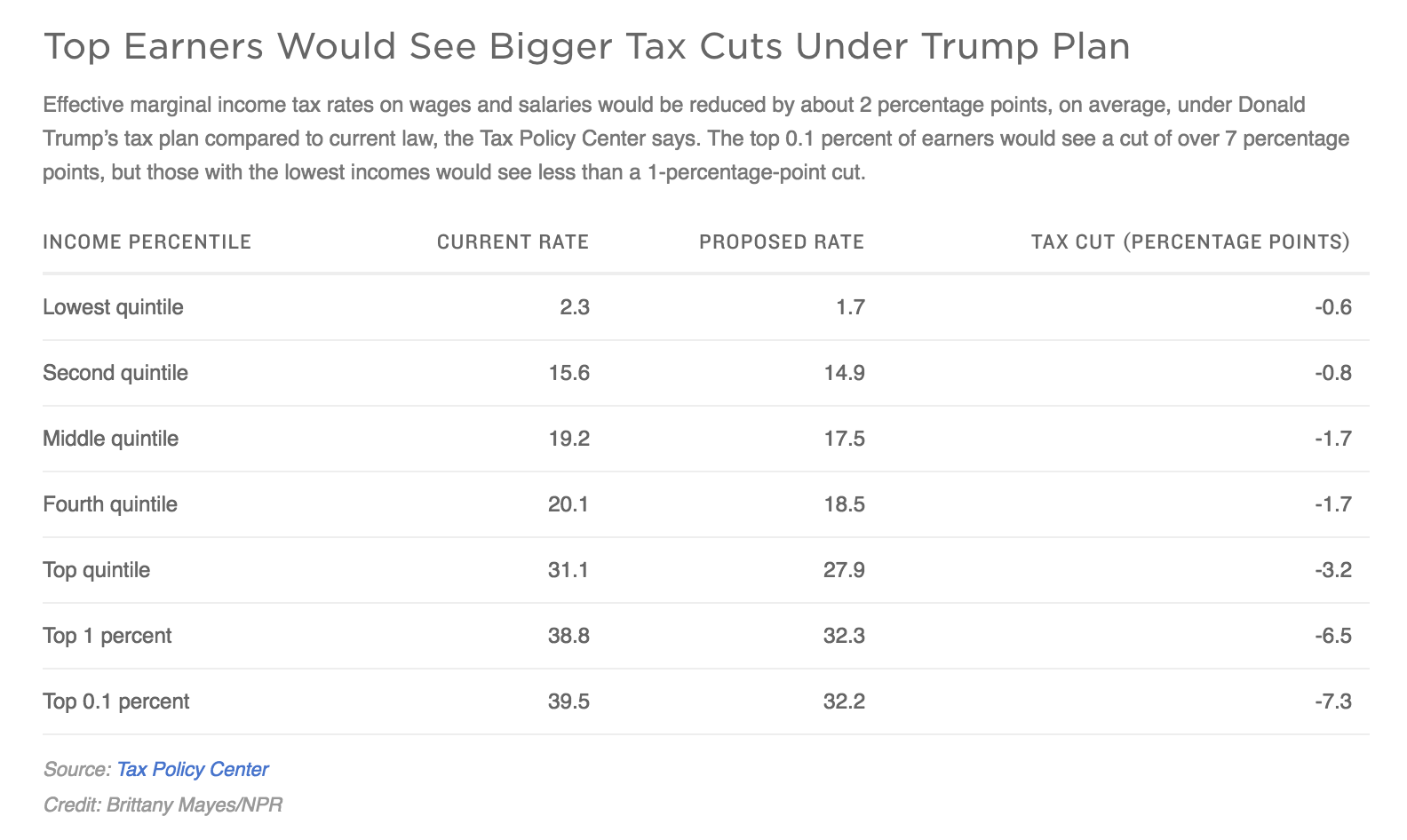

According to an analysis done by Batchelder in September, "about 20 percent of households with children and more than half of single parents would pay more for taxes." The Tax Policy Center looked at her analysis and found she may be correct. The group released data showing, on average, how big of a tax cut each income bracket would actually get.

NPR/Tax Policy Center - npr.org

NPR/Tax Policy Center - npr.org

So, on average, much of the lower and middle class would receive a tax break, but only a very small one. The rich would receive a large one.

How Trump's plans will affect the economy

Besides lowering income taxes for some, Trump also plans to cut corporate tax rates from 35 percent to 15 percent. The President-elect said he would offset the lost revenue by closing tax loopholes. However, UMass Amherst economics professor Richard Wolff told ATTN: that loophole closures won't be enough to make up for the lost revenue, especially considering Trump's plans to increase military spending and begin a major infrastructure program.

Wolff said Trump will likely consider two options to ensure the government has the revenue it needs: run a deficit or balance the budget by cutting social programs.

Wolff said, given Republicans' control of the House and Senate, and their ideological opposition to government spending on social programs, the latter option is far more likely.

"He either has to increase the deficit dramatically or, to follow the old playbook of the Republican Party... say that there isn't enough money to sustain, at current levels, social programs of all kinds. Since he has the entirety of the Congress now as Republicans, my presumption is they'll go that second route," he said. "You could see, as a first level of attack on the poor in America, a kind of savaging of social welfare."