What You Need to Know about President Obama's 400-Page Economic Report

By:

The annual Economic Report of the President is out. You can read it here. It's 400 pages so.... in case you don't have time to read it, here are some highlights.

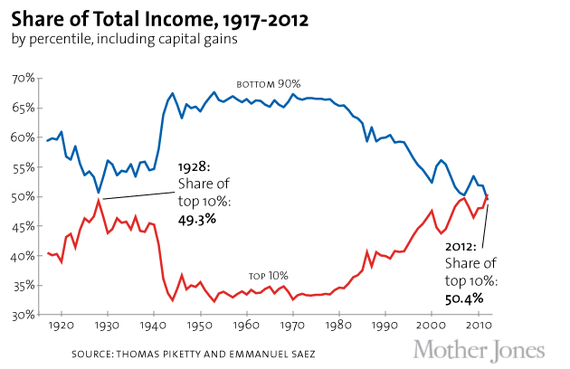

This year the president's report focuses on what he is calling "middle class economics" -- growing the economy specifically for the middle class. This is because while overall income growth has been positive, the middle and lower classes have not grown at the same rate as the rich. The disparity in growth has lead to a widening income gap between the rich and the rest of the country.

(It is important to note that the president's focus on income inequality does not mean that he thinks everyone should make the same amount of money, a common misunderstanding of the term. Income inequality refers to the relative rates of growth across the economy. For example, if rates were growing equally the CEO of a company and a retail cashier of that company would see their salaries grow at equal rates over time, even though the CEO would always be making more money. Because of income inequality, the CEO sees his rates grow rapidly while the cashier's rate of growth happens slowly or not at all.)

Over the past two years, the GDP grew at an annual rate of 2.8 percent (up from 2.1 percent in the first three and a half years of the economic recovery). Most of the recovery, however, has benefited the top 10 percent of households. In 2009, the median family income was $54,059, in 2012 it was $51,758, and in 2013 it had grown only $181 to $51,939.

The whole economy is growing, but middle class wallets aren't.

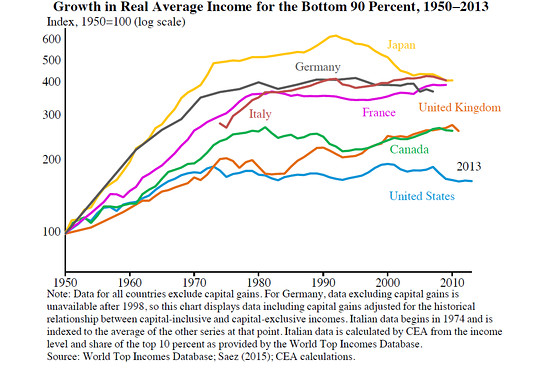

One goal of the president's report is to guide the conversation for the 2016 election, which will likely focus on income inequality. Gallup poll results show that two-thirds of Americans are dissatisfied with the distribution of income and wealth. Of Americans who make between $30,000 and $75,000 a year, 80 percent are dissatisfied. Not only has income inequality risen to unprecedented levels for the U.S., middle class growth is slower here than it is in other developed nations.

h/t The Wall Street Journal

There are seven chapters in the report that cover a variety of topics, but of particular interest (especially as you consider who to vote for in the next election) may be the report's explanations of the long-term factors that drive middle class incomes, the factors that drive the labor market, and the president's recommendations for middle class income growth.

Long-Term Factors that Drive Middle Class Incomes

The report identifies three key factors that drive middle class incomes: productivity growth, labor force participation, and income inequality. In other words, the middle class does best when the entire economy is more productive, more people are in the labor force working, and there is less income inequality. We can tell that these factors are important by taking a historical view.

Between 1948 and 1973 all three factors benefited the middle class, and it was at its strongest. Labor productivity grew at a rate of 2.8 percent annually, women increasingly joined the work force (one-third of women worked in 1948 and one-half did by 1973), and income inequality fell (the share of income going to the top 1 percent fell by about a third, while the share going to the bottom 90 percent rose just slightly).

Between 1973 and 1995 labor productivity growth slowed to 1.4 percent annually, and income inequality grew.. and grew, and grew. The share of the national income that went to the top 1 percent doubled, while the share that went to the bottom 90% fell. The bottom 90% saw their incomes decline 0.4 percent every year, but since women were still joining the workforce and increasing work force participation, middle class households weren't feeling the lowered incomes too acutely.

Between 1995 and 2013 labor productivity grew 2.3 percent annually, but income inequality worsened considerably. The bottom 90 percent of households were making only 53 percent of the income. In comparison, in 1973, the bottom 90 earned 68 percent. The labor participation rate also fell as women's entry into the workforce plateaued, and baby boomers began to retire. These trends make it clear why the economic collapse was particularly disastrous for the middle class, and while post-collapse productivity and labor force participation are slowly climbing, income inequality is not getting better. So the middle class isn't seeing the effects of the economic upswing. Since 2009, the top 1 percent of earners have made 96 percent of the country's income.

Factors that Drive the Labor Market

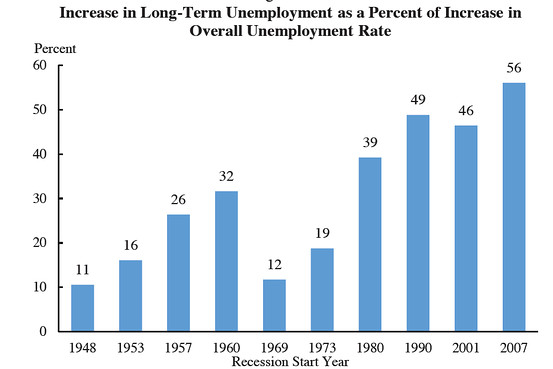

In 2014 the U.S. had the highest job gains since the late 1990s. Unfortunately, wages have been stagnant for the middle class for the past 40 years (as depicted in the graph above), so job growth isn't enough. Post-recession, the labor force faces unique challenges. The number of long-term unemployed and involuntary part-time workers is a major concern. Unemployment figures don't always accurately reflect these populations, and right now the number of these workers is historically high. Because the recession lasted so long, those who lost their job early and had difficulty finding one when jobs were scarce now have a long period of unemployment on their resume that is going to continue to hurt them even though there are more jobs available now. Similarly, people who were forced, for economic reasons, to accept underemployment (working part-time when they desire full-time work, and/or working in jobs for which they are overqualified because those were the only jobs available) during the recession will have a more difficult time finding full-time work that is reflective of their qualifications.

h/t The Wall Street Journal

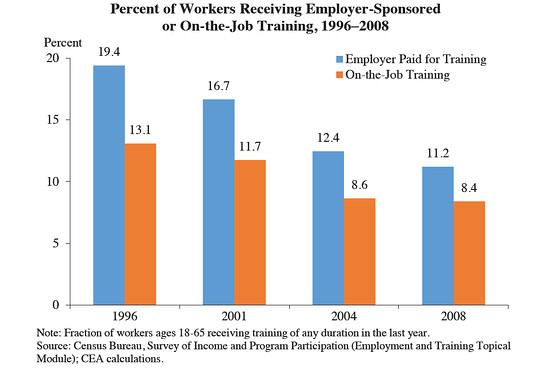

Also affecting the growth of the workforce is the lack of on the job training. Demand is growing for high-skilled workers, but more employers now expect applicants to have already received job training, often at their own expense. Income inequality increases when more workers need to go to college in order to qualify for jobs in which wages are stagnant. In other words, as employers provide less on-the-job training, non-wealthy people are taking on more expense (and student loans) to meet higher job qualifications for jobs that haven't had a correspondent increase in wages that would allow for a return on their education investment.

h/t The Wall Street Journal

The President's Recommendation for Middle Class Growth

The president's report also details the strategies he supports for rebuilding middle class incomes. To increase labor productivity, he suggests new education investments in pre-kindergarten to college (because a better educated workforce is a stronger workforce), and a new approach to business tax reform that encourages domestic investment and reduces inefficiencies and loopholes of the international tax system and expanding trade. To increase labor force participation he suggests the government invest in infrastructure which will create jobs (our infrastructure is crumbling), as well as new immigration policies, which will bring more workers in to replace those retiring. To lower income inequality, he suggests cutting taxes on middle class families and raising them on higher earners so that the middle class keeps more of their income without increasing the deficit.